“They’re open to all comers—and all comers often show up, including the underdog. Sometimes, the underdog wins.”

Peter H. Dimandis CEO of XPRIZE Foundation on incentive competitions in his book Abundance

Good competitions and tournaments attract all kinds of participants with little correlation to past successes and experiences. They offer the hope of winning to anyone with an idea and a desire to make it big.

This spirit of equal opportunity was alive and well at Finovate Spring 2015 in San Jose, California, where participants represented startups in nascent stages and established companies like INETCO and Vanguard. Over two days last month, May 13-15, crammed within seven-minute demo slots, 71 companies showcased their latest financial services products to a 1,400-strong audience. The final conclusion? Five winners were chosen as “Best in Show.”

Still, the real prize isn’t merely the vain declaration of being the “best.” Presenters hope to impress venture capitalists looking for a good investment, pique the interest of banks exploring partnerships or close deals with valuable customers. The exposure at Finovate could lead hopefuls to be the next big thing.

And there are case studies of this. Lending Club, Prosper and OnDeck were young startups when they presented at Finovate several years ago but are now each worth more than $1 billion. Even payments behemoth PayPal is a Finovate alumnus. Finovate facilitates connection and creates visibility for these companies. In the first three months of 2015, Finovate alumni raised $677 million, or more than 20 percent, of the $3.2 billion globally invested in the FinTech sector.

Finovate was founded in 2007 during the financial crisis when the industry was more focused on loss management than on financial innovation. Founder Jim Bruene shared his motivation for launching Finovate with me. “I really like trade shows, and before Finovate, there wasn’t a place you could see spanking new products,” he said.

Bruene’s early ambitions for Finovate may be unassumingly simple, but it is undeniable that Finovate has played a significant role in sparking one of the hottest and fastest growing technology sectors. Financial technology (FinTech) ventures in 2014 were at $12.2 billion, triple the $4.05 billion in 2013.

Finovate’s show format is a seven-minute live demo from each company in front of a 1,400-person audience.

Brand-Spanking-New FinTech

According to Clay Christensen’s The Innovator’s Dilemma, disruptive technologies represent breakthroughs rather than improvements to the way things are currently done. Innovations at Finovate are radical, not just mere progressions or digitalization of pre-existing banking and financial services.

Moven, for example, is a New York City company which utilizes the concept of “gamification”, behavioral design and wearable technology to help consumers budget and save. Stratos Card, a hardware and software innovator, aims to get consumers to switch to an all-in-one payment card. Alpha Payments Cloud reduces the time it takes for banks to integrate external information technology solutions through cloud technology.

The heart of the conference isn’t just finance but technology and its novel application whether it is analytics, biometrics, mobile or software. So much so, that there is a conference spin-off, FINDEVR, focusing on just new technologies rather than solutions.

Tackling New FinTech AreasWhen I first attended Finovate San Jose in 2014, I recognized a pattern: The innovation was in retail and small business markets. This observation stirred me. Coming from a large institutional bank, I felt that innovation was skewed toward capital markets and institutional deals where the highest margins and fees were at. Apple created a revolution in personal computing at a time when computers were mostly found in large institutions. This form of democratization empowered individuals for productivity and entrepreneurship creating a large ripple effect. I hope to see this parallel in the financial services industry.

FinTech newcomers might disrupt big banks, create only a dent in the industry or fizzle out (a debate that deserves another written piece). Whatever the final outcome, financial innovation in retail and small business markets is long overdue. Success is meaningful for macroeconomic growth and social impact when individuals are financially empowered.

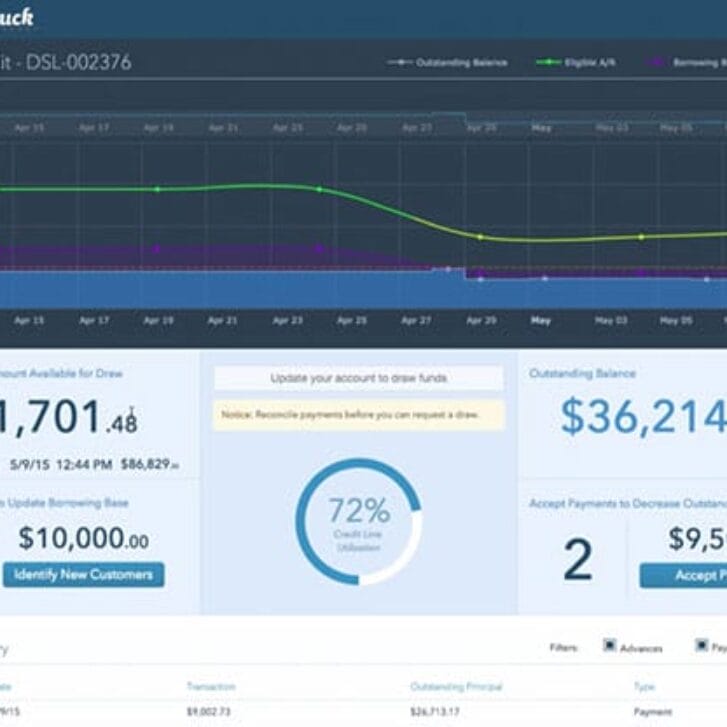

A Better Financial Future

Due to outdated ways of measuring creditworthiness, millions of small businesses and individuals are denied capital because of mispricing. Finovate alumni such as OnDeck, Kreditech and SoFi are applying new methods to serve these markets better. Foreign remittances still cost an average of 8.4 percent of the total amount sent and retail credit card transactions charge an average of 3 percent as card companies run on a system more than half a century old. Bitcoin companies such as Coinbase and ItBit are tackling this problem through the promise of cryptocurrencies. There are more ways to enable small businesses through their payment network. Companies like Kabbage are extending credit using merchants’ e-commerce transaction data while Clover Network is delivering sophisticated software solutions through point-of-sale.

Analogous to a tournament or competition, there can be only one winner (and maybe a few runners-up). Not all businesses will be disrupted and few Finovate participants will make it big. Regardless, ideas are being developed (there are 4,000 listed FinTech firms on AngelList) and money is pouring in. This is a good thing as it is about time we have a better future in financial services. Finovate is our clearest glimpse into this future.