Public perception of alternative lending is at an all-time high. Online lending companies using peer-to-peer lending and/or data analytics are seen as knights in shining armor to borrowers who feel neglected by banks and other traditional lenders. Is more financing what individuals and small businesses really need? And is taking a holistic and strongly principled approach to lending to a less empowered group in conflict with profitability? With a mission to “provide small business owners with unique, appropriate and affordable capital with honesty and transparency,” Wharton FinTech firm Dealstruck has its own answers.

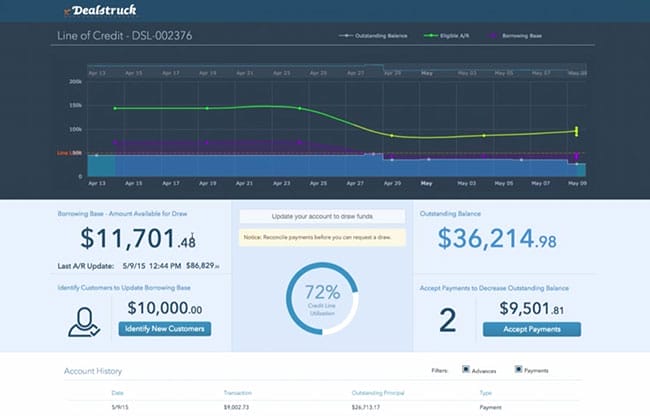

Aimed to be a one-stop shop to empower small to midsize businesses, Dealstruck offers users the ability to manage cash flow, empowering them to optimize interest payments and improve their credit scores. The goal is to graduate borrowers to healthier financial products, and Dealstruck considers it a victory when customers become eligible for financing at a bank or credit union.

Still, the borrower portal is part of a solution to empowering merchants. Unlike most online lending platforms, Dealstruck offers a suite of products from term loans to credit cards and factoring, defying the one-size-fits-all lending solution.

Author Paulynn Yu WG15 met with Dealstruck co-founders Ethan Senturia W08 (left) and Russell McLoughlin (right) at Finovate Spring 2015, where they worked the floor and presented.

Upon graduating from Wharton, Dealstruck co-founder Ethan Senturia W08 spent one year working for distressed debt units at two banks, but he realized he wanted to explore his entrepreneurial inclination (both his parents own businesses). He joined online media company, Ampush, nearly on the ground floor with its co-founders Nick Shah W06, Chris Amos W06 and Jesse Pujji C06 W06, working for two years with them and leaving in 2012 as vice president of online media.

While background and blood might explain Senturia’s interest in credit and startups, one could guess where his deep level of empathy with borrowers comes from. When I asked him about the trade-off between future sales and customer empowerment, he responded:

“Sure, we might lose a transaction sometimes. But if it’s good for customers in the long run, that’s fine. We believe in building a trusted brand and I believe it will pay off in the future.”

Such a stance requires a shared discipline and commitment to succeed. While Dealstruck’s mission is to do good, Senturia’s vision for growth and being best in class is not lost within the company and among investors. Officially launched in October 2013 with co-founder Russell McLoughlin, Dealstruck is now in 43 states. The company has recently secured $8.3 million in equity funding led by Trinity Ventures and a $50 million credit facility led by Brevet Capital Management.

Lack of available credit after the financial crisis created the right conditions for alternative lending companies to flourish. But in the event of rising interest rates or a recession, customers of alternative lending companies might struggle to repay loans, especially since the borrower profile skews to the riskier side. When debt-ridden borrowers use more alternative borrowing to pay current obligations, an undesirable turn of economic conditions could lead to a doomsday scenario. This is when a borrower-centric business might pay off.

In an April interview with Techcrunch, Senturia expressed his plans to survive future economic downturns as the reason behind its recent equity fundraising. Dealstruck could be in for the long-run as a trusted brand among small businesses.