This is Part 2 of a three-part series on entrepreneurship. This installment reveals why we are not in another coming of the tech bubble. Part 1 of “Next Generation Entrepreneurs and the Golden Age” addressed the sheepish questions that may be holding you back.

We live in very interesting times. It’s 2010 and I’m at a family reunion. We’ve just barely survived the most cataclysmic financial crisis in modern history and one of my cousins asks me, “How can tech be doing so well while the rest of the economy is doing so poorly?” I did my best to answer but the question kept eating at me. I remembered Michael Porter’s Harvard Business Review article about the Internet being the sixth force and how it would disrupt all of the previous five forces cited in his strategic model.

Fast-forward four years and a five-year-old company, WhatsApp, is bought for $19 billion by Facebook, a company that itself is only 10 years old but worth a mighty $170 billion. Just two years earlier, when Facebook went public, the media was asking for Morgan Stanley’s head, and it wasn’t long before some were calling for Facebook CEO Mark Zuckerberg’s head for what was perceived at that time as an overpriced initial public offering. Except that it wasn’t. Investors who’ve held on to their IPO stock should now be very happy campers.

When five and 10-year-old companies are valued at $19 billion and $170 billion, respectively, sometimes I hear the “bubble” word. This is a word that has very personal meaning to me. I lived through the ultimate bubble when I lived in San Francisco from 2000-2003. I remember going to Starbucks and the barista lamenting that they used to be one of the heads of marketing at Pets.com. I remember how one person I knew, Tony Perkins, the founder of the venture capital blogging network AlwaysOn, called it in his book The Internet Bubble in November of 1999. Almost no one believed him at the time, and then—wham!—it happened. It was very painful. I had to let 70 percent of our people go at Coremetrics while our dot-com client base rapidly dwindled from 100 to two. We survived, barely, and fortunately thrived later.

Today, I believe we are in the opposite of a bubble. We are in the new golden age of technology. While it always makes one nervous to make a forecast like this, I think the years ahead will be some of the best ever for technology entrepreneurs. I’ve been putting our money where our mouth is with Hurt Family Investments and our growing technology portfolio.

To understand why, first you have to understand what is happening with exponential, digital and combinatorial technologies. The book review I wrote on The Second Machine Age explains this and the book itself is a must-read on this topic. We live in an unprecedented time and everything is speeding up, and not just with Internet technologies. When I was a kid I would tell my elementary school teachers that computers would transform all industries. That as they speed up, all industries would change more quickly. I was too young to use words like “disruption” but that is exactly what would happen, and at an accelerating pace. Whether it is the “Internet of things,” smartphone and tablet adoption, the social revolution, 3D printing, personalized medicine, nanotechnology, or artificial intelligence and machine learning, disruption is happening everywhere.

Today, many people with purchasing power are online and online is portable. We all have a supercomputer in our pockets and a rare few of us even wear them on our faces—me not being one of those. Your ability to reach the world market has never been greater or more efficient. The speed at which you can launch a new business because of cloud services like Amazon’s Web Services or Google’s Cloud Platform has never been faster. The price to experiment and potentially create something valuable that the world needs now has never been lower.

There is more access and knowhow on how to launch a business now than ever before. Accelerators and incubators are thriving and launching all over the world. Some venture capital companies are seeing record returns. Facebook’s IPO made Accel Partners a very rich return and Twitter’s IPO was a huge boon to Mike Maples Jr.’s Floodgate. Uber’s recent $18.2 billion valuation and presumed IPO will do the same for Wharton’s own First Round Capital, headquartered just off the Penn campus and founded by Josh Kopelman, W’93. Business schools are much further along in teaching entrepreneurship than they were when I attended Wharton from 1997-1999. Case studies are more developed. Entrepreneurs come back more often to explain to students how they did it, sometimes in the form of entrepreneur-in-residence. I served in this capacity at the University of Texas at Austin for the last academic year, and I go back to Wharton every year to do this as well. Entrepreneurship in terms of graduating student interest is at record levels. Entrepreneurial books are more sophisticated than they’ve ever been about how to identify and rapidly capitalize on an opportunity in this new golden age. There are entrepreneurial blogs everywhere available for free to anyone with the ambition to read them. One of my favorites is First Round Capital’s Review. The global financial crisis has shaken everyone’s confidence in “the system,” even to the point where people would blindly trust Bitcoin. Unemployment globally remains high and that creates more entrepreneurs out of necessity than ever before.

Valuations are also more entrepreneur friendly than before. I believe this is not only due to venture capital “greed,” but rather also because the Internet and computers, mobile platforms included, have made capitalism more efficient.

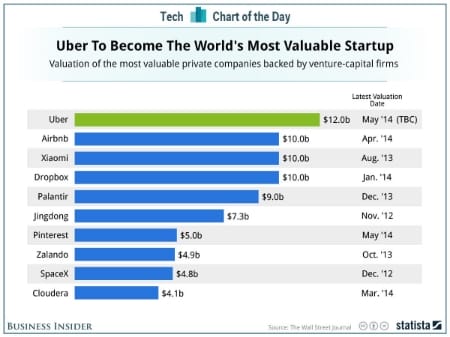

In May, Business Insider posted this chart of the day when Uber was rumored to be getting valued at $12 billion. The actual number turned out to be a $18.2 billion a few weeks later.

To me, as an Austin native, one interesting aspect of this chart is that seven out of these top-10 privately valued companies were founded in Silicon Valley. The other three, Jingdong, Xiaomi and Zalando, weren’t founded in the U.S. But there is no doubt that Austin is better than it has ever been from a tech entrepreneurship perspective.

So what is the reason that Silicon Valley dominates? It is simply a law of numbers thing. It takes a number of experiments to produce top-10 global valuation outcomes and Silicon Valley has more of everything in entrepreneurial tech than any other place in the world. Remember, you can still produce huge outcomes even if startups aren’t top-10 globally. To understand this more, I suggest you read about venture capital returns and the power-law distribution characteristics of them in this blog post by Tren Griffin on lessons learned from Marc Andreessen.

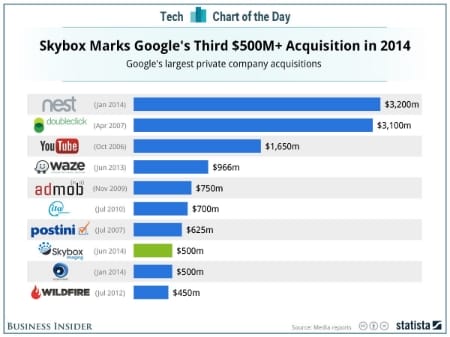

Speaking of entrepreneur-friendly valuations, don’t forget about mergers and acquisitions. Google recently made its third $500 million-plus valuation of this year, as you can see in the chart below. Again, valuations are more efficient and rapidly rising as current and future value is more quickly realized in this new golden age of technology. I remember how much Google was ridiculed for paying $1.65 billion for YouTube in 2006. But Nest for $3.2 billion? Hardly a word about it.

So if this is the new golden age of technology, who are these entrepreneurs? They are increasingly female, with 25 percent more female billionaires on the Forbes 2014 list than on last year’s list. A great example is Elizabeth Holmes, who is 30 and worth $4.5 billion, at the helm of her startup Theranos, which is shaking up the blood-testing industry. (She’s featured in this recent Forbes article.) Theranos is not exactly an Internet or mobile startup but it is leveraging the ingredients I cited above. Aspiring technology entrepreneurs are increasingly younger. As this article on Generation Z points out:

“[Generation Z is] more entrepreneurial than millennials. About 72 percent of high school students want to start a business someday and 61 percent would rather be an entrepreneur than an employee when they graduate college, according to a study by Millennial Branding, a consulting firm, and Internships.com.”

Global youth is more entrepreneurial—out of necessity as well as from benefiting from all of those that came before them. A good book to ground you on this is by my friend Christopher Schroeder. Startup Rising: The Entrepreneurial Revolution Remaking the Middle East.

In short, there has never been a better time to launch a technology venture regardless of your age. The way we are all networked together with mobile supercomputers in our pockets and always online makes the opportunity to identify and capitalize on opportunity faster and cheaper than at any point in history. The way we are all sharing and learning from one another about how to be entrepreneurs is at an all-time high. There are no excuses. This should be your time. Are all of the great ideas taken? No. Are you too old? No. Remember, you can always surround yourself with millennials and Generation Zers, like my friend Jeremy Liew did when he discovered Snapchat. Is capital available? Yes, more so than ever. But how do I learn? Blogs, incubators, accelerators, venture capitals, angel investors, books, mentors. You have never had access like you do now. On the mentor/networking front alone, LinkedIn makes it almost embarrassingly easy, and they have a $19 billion valuation to prove it.

I would love to hear your thoughts.

Editor’s note: Read Part 1 of Brett’s blog series “Next Generation Entrepreneurs and the Golden Age.” Or skip ahead to Part 3—about defining the soul of entrepreneurs.

This is an adaption of an article posted originally on July 12, 2014, on Brett’s Lucky7 blog.