This is the first installment of a three-part series on entrepreneurship. Part 2 will explore who makes up this new generation of founders and why I believe we are in the new Golden Age of tech, and Part 3 will define the entrepreneurial soul.

It’s March of 2013 and I’m at Wharton serving as an entrepreneur-in-residence when I get a question that baffles me. I’m speaking at the Penn Founders’ Club, where all University of Pennsylvania students are welcome as long as they are fervently working on a real business while they are in school. I’ve just wrapped up my opening comments and it is time for Q&A. The baffling question: “Have all of the really big ideas already been thought of?” I couldn’t believe it when I could see the student was being serious and not just pulling my leg, and I was fired up. I passionately described how the world always needs entrepreneurs to drive it forward, and there are always ideas—everywhere— if you just look hard enough. I talked about how I had just read the book Abundance and wrote the longest book review of my life on it at my website Lucky7.io. There are thousands of great ideas in the book for entrepreneurs to solve the world’s biggest problems.

A few months later, Waze gets bought for $966 million by Google. A few months after that, Snapchat gets a rumored $3 billion offer from Facebook, which I wrote about in this Lucky7 post on valuations. And then, almost a year after receiving that question at Penn, WhatsApp gets an acquisition offer of $19 billion from Facebook, one month after Google buys Nest for $3.2 billion.

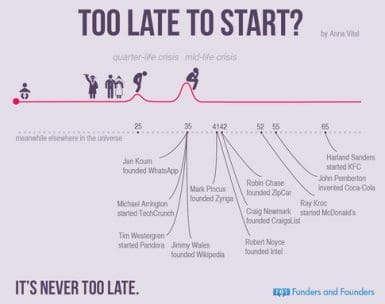

Fast forward to a month ago and I see a question on Quora that catches my eye: “Life: I am 35 and I have not achieved much in life. Is it too late?” The top two answers out of 176 and counting have a combined 4,900 “upvotes.” I especially found this graphic compelling:

Then you have the Values.com billboards, of which this one below caught my eye years ago. Henry Ford failed miserably with his first startup, the Detroit Automobile Company, which he started at age 36, but then—at the age of 38—he founded his second venture—Ford Motor Co., which grew into an industrial colossus.

And in Austin, we have an entrepreneur, Cotter Cunningham, who started his first  venture at the age of 46, which failed, but then on his second, RetailMeNot, it went public in July 2013 and is worth almost a billion dollars. I wrote about Cotter and did my best to motivate entrepreneurs to keep going and try again in “If at First You Don’t Succeed. …”

venture at the age of 46, which failed, but then on his second, RetailMeNot, it went public in July 2013 and is worth almost a billion dollars. I wrote about Cotter and did my best to motivate entrepreneurs to keep going and try again in “If at First You Don’t Succeed. …”

More recently, I woke up to reading this WSJ article about Evan Baehr and Will Davis in Austin, who pivoted from their failed venture Outbox, which was very ambitious, to a new venture, Able, which is even more ambitious, and which I believe has much greater potential and certainly less friction. I also love their blog post announcing the pivot, which they’ve been working on for the past eight months. I was fortunate enough to see their pitch for Outbox while I was at Austin Ventures and it was one of the best I’ve ever seen. This time around, they are that much wiser and I’m hoping it will be a home run for them and the Austin startup community. It is awesome to see Mike Maples, Jr. and Peter Thiel stay the course to support them.

Reading that article led me to this one on Medium by Nikki Durkin, former CEO of 99Dresses. It is gut-wrenching, and that almost happened to me at Coremetrics. Keep walking, Nikki. Stay in the arena.

So I have a call to action for you today. Get in the arena. We need more brave people to change the world for the better. Stop asking your sheepish questions and let’s get going. Debra and I are having a lot of fun doing our part to help with Hurt Family Investments, and you can see some of the entrepreneurs that we feel fortune enough to help on our portfolio page. We’ve been collaborating with others that are dedicated to helping in Austin too, including Austin Ventures, Silverton Partners, LiveOak Venture Partners, Capital Factory, TechStars Austin, Incubation Station and over a hundred other individual investors and family offices that we know.

I would love to hear your stories in the comments below, and I look forward to writing part 2 of this series.

Editor’s note: This is an adaption of an article posted originally on June 28, 2014, on Brett’s Lucky7 blog. Part 2 of this blog series—about who makes up this new generation of aspiring entrepreneurs and why Brett believes we are in the new Golden Age of tech—will appear in two weeks. Please stop back then.