The international business community in the last few years has recognized the strategic importance in most industries of having a direct or indirect global presence, covering not only the Western markets but also the major emerging world markets, including the “BRICS” and possibly also other attractive regions such as the Middle East and South-East Asia (ASEAN).

In several key sectors of the economy—such as automotive, trains, farm equipment, appliances, building materials, metals, chemicals, machine tools, fashion, distribution, financial institutions, telecom, etc.—those companies that did not comply to the globalization imperative are suffering. The new “motto” is: “Globalize or Die.”

However, the process of business globalization is complex and dense with obstacles; there are many battlefields with a diversity of customers, cultures, tastes, competitors, infrastructures, regulations, duty/tax frameworks and, ultimately, rules of the game. The common denominator is the need to invest time and human and financial resources with returns that are usually not immediate and imply considerable risks. As a consequence, the globalization battlefield continues to cause several “dead and wounded” among “business warriors,” with few real winners.

Are there some general rules to succeed in globalization? My answer is “Yes!”.

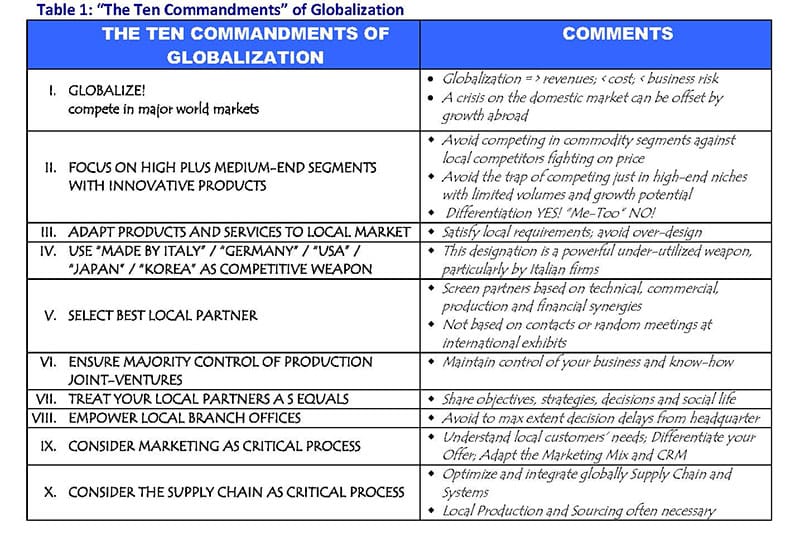

Having worked for over 25 years for Western multinationals conquering Asia, for Korean chaebols attacking West Europe and North America, and for medium-sized Italian companies looking for new markets, I have systematically verified that success and failure rely on the respect of few general principles, which I have named the “10 Commandments of Globalization.”

The evidence that I have collected on the validity of the above 10 Commandments of Globalization does not have a statistical validity. It is based on the observation of success and failures of a limited number of companies in their efforts to penetrate new markets. I provide a selected number of these illustrations below, in connection with the performance of multinational companies in the Chinese automotive and home appliance industries. The following analysis is solely based on publicly available information.

The evidence that I have collected on the validity of the above 10 Commandments of Globalization does not have a statistical validity. It is based on the observation of success and failures of a limited number of companies in their efforts to penetrate new markets. I provide a selected number of these illustrations below, in connection with the performance of multinational companies in the Chinese automotive and home appliance industries. The following analysis is solely based on publicly available information.

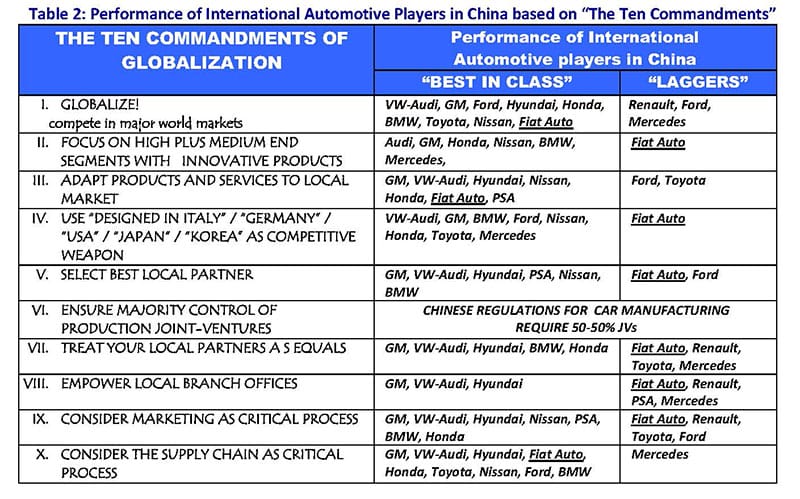

EXAMPLE I: Penetration of the Chinese car market by international players

Table 2 below indicates that the leaders of the Chinese car market—GM, VW/Audi, Hyundai and Honda—have systematically “respected” most of the “10 Commandments,” albeit with different approaches.

In the volume car business in China and India, Fiat Auto represents an emblematic failure. In contrast to the behavior of its Fiat Group sister companies—Iveco, CNH, Comau and Magneti Marelli—Fiat Auto did not observe six of the 10 Commandments, as shown in Table 3, and this is reflected in its results. Since 1999 Fiat Auto made cumulative investments of over €850 million, while in 2012 it sold only 14,000 units of the Viaggio (the only model being produced locally), equivalent to only 0.2 percent of market share in segment “C.” The cumulated losses are in the order of several hundred millions.

In the volume car business in China and India, Fiat Auto represents an emblematic failure. In contrast to the behavior of its Fiat Group sister companies—Iveco, CNH, Comau and Magneti Marelli—Fiat Auto did not observe six of the 10 Commandments, as shown in Table 3, and this is reflected in its results. Since 1999 Fiat Auto made cumulative investments of over €850 million, while in 2012 it sold only 14,000 units of the Viaggio (the only model being produced locally), equivalent to only 0.2 percent of market share in segment “C.” The cumulated losses are in the order of several hundred millions.

Fiat’s direct competitors, including VW, GM, PSA, Honda and Hyundai, entered China at the same time or even subsequently of Fiat. They are selling millions of vehicles per year in China, achieving margins that well compensate for the downward fluctuations of European and USA markets. The trump card of Fiat Auto in China (and India) is the newly acquired Jeep brand, highly aspirational to young Asian professionals. Jeep vehicles will be produced in China.

The 10 Commandments of Globalization provide an interpretation of the competitive dynamics also in the Chinese luxury cars segment, where Audi in 2012 was the winner a market share of 38 percent, compared with BMW (26 percent) and Mercedes, catching up but with a share of only 19 percent. The success of Audi and BMW versus Mercedes is mainly due to their earlier market entry (see Commandment I: “GLOBALIZE!”). Audi started producing in China 14 years before BMW and 16 years before Mercedes. Mercedes is still behind competitors in terms of relationships with partners and suppliers and level of decentralization from headquarters (See Commandments VII and VIII).

EXAMPLE II: Penetration of the Chinese white goods market by international players

Table 4 shows that also in the white goods industry, the most successful international companies in China are those that best “respect” the 10 Commandments of Globalization.

Indesit Company has focused its business coverage in Europe and, consequently, did not follow the first Commandment (“GLOBALIZE!”). Consequently, Indesit Company could not fully capitalize the strong potential of its products and know-how in terms of revenues, economies of scale, risk dilution and profits. Just as reference, the Asian white goods market in 2003 had the same size in volume of the European market (including even Eastern Europe, Russia, Ukraine, etc.), while today it has twice the size. Most of Indesit direct competitors—such as Electrolux, Whirlpool, LG, Samsung and Bosch-Siemens—have taken full advantage of the growth of emerging markets and comply with Commandment I.

Indesit Company has focused its business coverage in Europe and, consequently, did not follow the first Commandment (“GLOBALIZE!”). Consequently, Indesit Company could not fully capitalize the strong potential of its products and know-how in terms of revenues, economies of scale, risk dilution and profits. Just as reference, the Asian white goods market in 2003 had the same size in volume of the European market (including even Eastern Europe, Russia, Ukraine, etc.), while today it has twice the size. Most of Indesit direct competitors—such as Electrolux, Whirlpool, LG, Samsung and Bosch-Siemens—have taken full advantage of the growth of emerging markets and comply with Commandment I.

As result, Indesit was put on sale and acquired by Whirlpool in 2015.

Whirlpool as the most international white goods player, together with Electrolux and contrary to Indesit, ranks No. 1 in Commandment I (“GLOBALIZE!”). However, its quest for global leadership met several difficulties, particularly in China, where it suffered a heavy initial debacle. Whirlpool landed in China in early 2000, with four joint ventures; after two years it closed two of these JV, and after more than five years, it was still losing money. Why? It did not observe eight of the Commandments, as summarized in Table 5.

To improve its position in China, Whirlpool in late 2014 has acquired 51 percent of Hefei Rongshida Sanyo Electric for $552 million.

This company produces mainly washing machines and refrigerators. This acquisition, at least for a period of three to five years, should increase Whirlpool business risk in China. Whirlpool China will operate mainly in the volume business against stronger competitors, such as Haier and Little Swan; will have to manage and reposition a large number of brands; will have to invest heavily in plant upgrade and integration; and will have to negotiate all key decision with a local partner.

This company produces mainly washing machines and refrigerators. This acquisition, at least for a period of three to five years, should increase Whirlpool business risk in China. Whirlpool China will operate mainly in the volume business against stronger competitors, such as Haier and Little Swan; will have to manage and reposition a large number of brands; will have to invest heavily in plant upgrade and integration; and will have to negotiate all key decision with a local partner.

The champions of globalization in the white goods business are LG Electronics and Samsung Electronics.

LG Electronics has successfully applied in China its “bouncing” strategy that was defined in 1993 and consists of two steps. First, LG has achieved a strong market share in China, India and other Asian markets, while observing most of the 10 Commandments and setting up local, state-of-art plants with low labor cost. As a second step, it has exploited the economies of scale and cost advantages from the Chinese and Indian operations as a competitive weapon (a “springboard”) to attack the world markets, starting from Australia and the USA.

Samsung Electronics has implemented the 10 Commandments of Globalization with even better discipline and results than LG. Samsung has applied the same “bouncing” approach as LG, while offering products with high innovation at a premium price (giving it a higher score on Commandment II than LG). Samsung was able to apply the same strategy in smart phones, tablets and home appliances with tremendous success worldwide.

These examples show how the process of enterprise globalization, while being a requirement for survival, is also a hurdles race, in which participants must apply a planned and systematic approach and avoid improvisations. The 10 Commandments of Globalization provide a useful check-list for planning and for identifying change requirements.

My direct experience indicates that the relative importance of the 10 Commandments of Globalization varies according to the nature of business, location, company size and strategic posture.

Commandment III (local product adaptation) and Commandment VIII (decentralized decision-making) are more important in consumer goods industries, while are less important for industrial goods industries such as machine tools, computers, software, etc.

Typically, small and medium-size companies that do not have the financial and managerial resources to enter directly remote markets such as China or India must assign a higher importance to Commandments V, VI and VII—related to partner selection and management. Their need for a local JV partner well matches with the needs of many Chinese and Indian players requiring access to advanced design and technology to defend their domestic market share against foreign multinationals.

Therefore, I expect that a huge number of medium-small companies in many sectors and all continents will try to overcome their issue of critical mass to globalize via cross-border M&A. This will include any type of strategic combinations: acquisitions, joint ventures, licensing agreements, mere alliances, etc., where Commandments V, VI and VII will be critical for success. If managed properly, this approach could be cheaper and faster to implement than “go alone” alternatives.

The validity of the 10 Commandments of Globalization as introduced in this article is based on my professional experience in assisting multinationals and smaller business entities to enter Asian markets and on the analysis of two specific industrial sectors in China as indicated above. These principles are also in line with the existing body of knowledge in strategy and marketing. It goes without saying that in order to acquire a more scientific recognition, a statistical testing would be required.

Editor’s note: The original version of this article was published in Italian by Harvard Business Review Italy in the April 2014 issue.