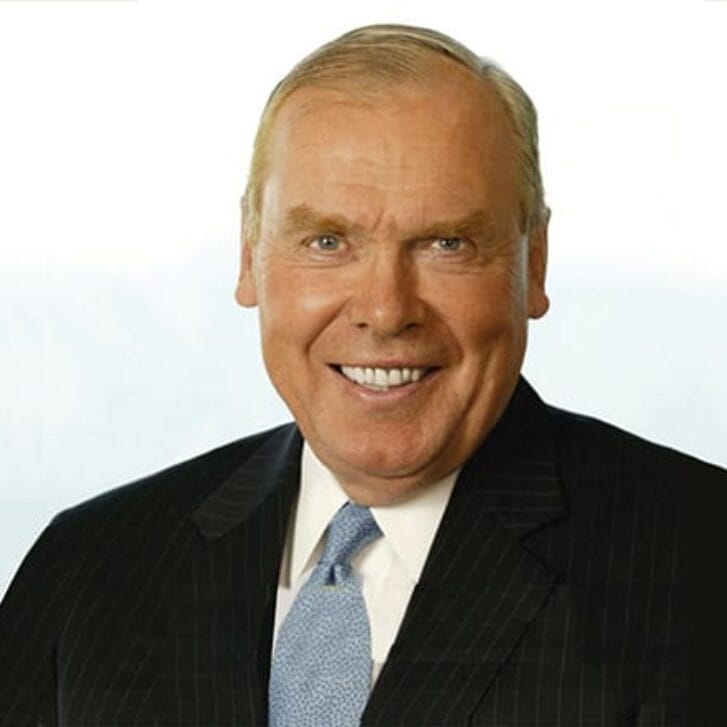

Listeners of Gimlet Media’s The Pitch podcast will be familiar with Phil Nadel W88 as a featured investor who delivers thoughtful critiques to hopeful startup founders as they vie for investment. It’s an expertise Phil has honed over the course of his 30-year career as a serial entrepreneur, angel investor, author, and well-known industry speaker. What fans of the show may not realize is that his passion for business began as an undergraduate student at The Wharton School majoring in entrepreneurial management. It was a bit of a homecoming for Phil when he returned to the Wharton campus for The Pitch’s first-ever live show on the road to hear from three young, local startups embarking on their own entrepreneurial paths.Before the taping, we caught up with Phil to learn more about what makes a startup stand out from the crowd, his advice for student entrepreneurs, and what Wharton was like in the 80s.

What separates a good pitch from a great pitch?

I think there are some tangible things and some intangible things that separate good pitches from great pitches. I would say the founders’ vision and passion are some intangibles that are really important that we like to see. We like to invest in founding teams or founders that have a vision for where they are taking this company beyond the current product or solution that they’re offering. What’s next? Where are they taking the company in the future? What do they see as the long-term vision for the company? That’s one thing. Passion is another, and that’s just about really having this burning desire to do what they are doing. That can come through during a sales pitch or a pitch for their product, service, or business. So, when you are pitching, whether it be to the customer or the investor, the passion really needs to come through. We like to see that as well because it’s an indication that the founders are in it for the right reasons and in it for the long haul.

A couple of things I would mention: the best pitches have the founders authoritatively teaching about the opportunity. They’re teaching the investors about the problem that they’re solving, how they’re solving it, and why it makes for a good business. As investors, we want to invest in someone who knows the business and is an authority in that business.

The final thing, which I guess is more tangible, is that founders who are pitching need to know everything about the market, the competition, and their numbers and KPIs (Key Performance Indicators). They need to know the metrics that drive their business. If we ask them during a pitch: “What’s your customer acquisition cost?” Then they need to know it cold. There can’t be fumbling around, or promises to get back to you. If that’s a key metric, then they need to know that.

Along those lines, what’s a question that entrepreneurs are rarely prepared to answer, but should be?

The question that entrepreneurs are rarely prepared to answer—and probably because they don’t get asked this question very often—is: “What would you be doing if you weren’t doing this?” The reason I ask that question sometimes is to get a measure of how dedicated they are to this business and to see if they really have the burning desire, the passion, for doing this. If the answer that they give is something like: “I’d probably be working as an analyst at Goldman Sachs,” that’s the wrong answer. I don’t want to hear that their fallback position is a cushy job at Goldman Sachs with an annual salary of $150K plus lots of bonuses and perks. That’s not going to make them hungry to make the business a success. I want to hear that their fallback position is nothing. This is all they want to do. This is all they think about doing and not doing it is not an option.

When you ask that question, do any entrepreneurs give good answers?

I don’t think any of them are prepared to answer it, but the ones who are the truly outstanding founders, who are truly dedicated to the mission and the vision of the company—their answer really comes through very honestly. They don’t have to think about it. It’s like a knee-jerk reaction: “Well, this is all I want to do, this is the only thing.” Whereas other founders will think about it and come up with: “Well, I guess if I weren’t doing this I would be working for my parents’ business or doing this or that…” Those people didn’t prepare for it, but it’s not a matter of preparing, necessarily. What I’m looking for is someone who really hasn’t thought about doing anything else. So, it’s not that they should be prepared. It’s a question I like to ask that I know they haven’t really prepared for.

Nadel (left) on stage with fellow investor/judge Jillian Manus and host of The Pitch Josh Muccio as they kicked off the competition.

What’s your advice for student entrepreneurs?

I think that generally speaking, college is just a great time for aspiring entrepreneurs. It’s a great time to experiment and take lots of risks because, in college, you really have the lowest cost of taking risks. You don’t have a family, you don’t have big financial obligations. You’re still, for the most part, being supported by your parents, and you have a world of options available to you. It’s a great time to experiment. These days, it’s become so inexpensive to start a new business that you can run all sorts of low-cost experiments on different businesses to try, different products, different methods of selling. Even if these things fail, you inevitably learn a lot in failure and you can apply those lessons to future opportunities and businesses. By doing this, students can dramatically enhance their classroom education. They should be focusing on the education they can get while at school, not just in school—beyond just in-classroom learning. A college atmosphere brings with it lots of opportunities. You have opportunities to address a dense cluster of people that you can experiment with and try selling products and services to in a very tight geographic area. You have opportunities to network with students and professors, to build up your long-term network. I still keep in touch with and do business with people from when I was at Wharton.

Another thing: we all know that businesses start and end with sales. If there are no sales, there’s no revenue, and there’s no business. I feel like every aspiring entrepreneur needs to understand and be good at sales—even people who are tech founders and strong on the product development side. So, why not think of a product you want to sell and take out some ads online? Do some Google AdWords, do some ads through social media and work on the ad copy. Force yourself to focus on the benefits of your product instead of just the features, and force yourself to distill down to the most essential sales attributes, on conversion rates and getting your customers fully onboarded and keeping the customers happy. Even if you have no interest in pursuing those experiments long-term, you’ll learn a lot about sales.

As an investor, what are you looking for in early-stage companies?

In order to justify an investment, you ultimately have to have the potential for a large exit, a large sale. And in order to have that potential, you have to be addressing a large market. We want to see that the entrepreneur is solving a real problem or somehow making their customers’ lives better, improving their lives in a meaningful way. We like to see that what they’re developing or what they have developed is proprietary or defensible in some way, so that they can defend themselves against potential competitors.

We also like to see sort of the early indications of product market fit. What that means in my world is, I like to see that someone, at least one person or one customer, is willing to pay some money for the product or the service. We can listen to pitches and look at projections until the cows come home, but until there’s a sale, it’s all speculation. We like to see that early indication that the company has actually sold their product or service at least to a small degree. And, in that same vein, we like to see that there’s some early indication that the company knows how to acquire customers in a scalable way. The companies we invest in certainly don’t have to have all the answers when it comes to customer acquisition, but they should be in the beginning phases of understanding what sales and marketing channels they can use.

And, we want to see that they are raising a realistic amount of money. That, based on the projections, they are going to have at least twelve months of runway, but preferably more like eighteen months. We don’t want entrepreneurs having to focus all the time on raising money—we want them focused on building the company.

For you, a Wharton student who graduated in 1988, did you feel like there was entrepreneurial spirit when you were here?

I was an entrepreneurial management major at Wharton. For me, although I certainly appreciate the importance of finance, I’m all about entrepreneurialism, and I was able to feed my passion for entrepreneurialism at Wharton. There were certainly a lot of people in my class who were focused on finance, but there were a large number also who were focused on building businesses. It’s just a matter of the groups you participate with. I thought that the classes I took at Wharton taught me how to think about starting a business, taught me how to write a business plan, taught me about sales and marketing.

I think Wharton is sometimes known as the finance school, but I don’t see it that way myself because I know so many fantastic entrepreneurs who graduated from Wharton, and I know that the entrepreneurial spirit not only was alive and well when I was there but is thriving today. I saw it through my son, who just graduated and friends of his at Penn and at Wharton who also were starting businesses. I talk to a number of recent Wharton graduates, founders who are pitching to me, so I see it day-to-day. I see Wharton’s imprint on young founders all the time. I know that the school is continuing to educate future entrepreneurs because I see it.

Editor’s note: This post was originally published on Wharton Stories. Read it here. Gloria Yuen and Elis Pill contributed to this story.