A core element of President Donald Trump’s populism is his claim that trade is hurting America and that the new administration will do something about it.

Here is his argument: Exports are good because they create American jobs. Imports are bad because they destroy American jobs. The way to make America great again is to reduce imports and increase exports, because this will bring good jobs home and create more good jobs in America.

Hence all the talk of border taxes, border adjustments and tariffs—particularly on “unfair” traders like China, Germany and Mexico.

This protectionism clearly sells as politics. But what about the economics?

I don’t want to spend time making the case for imports, since they reduce the prices we pay for the goods and services we consume. Nor will I make the case for the benefits of free trading even if other countries don’t, as exploiting a country’s comparative advantage is good for growth irrespective of what others do. Nor do I want to speculate about how other countries will respond if the U.S. raises barriers to entering the American market, in what looks like the specter of trade wars.

Instead, I want to make a simpler point: The Trump administration’s proposed trade policies won’t achieve the goals they are designed to accomplish. Trade protection won’t bring production and jobs back to America because tariffs are completely unsuited to today’s global economy, which is characterized by the global supply chains and global distribution networks of multinational corporations.

To do so, I will apply a simple thought experiment to three iconic American multinationals: Apple, Boeing and GM. What would happen if the U.S. imposed a 20 percent tax on their “imports” into the country?

My answer is somewhat different for each firm, because their business models are different. But the one constant is this: Imposing tariffs on imports into the U.S. would not bring production or jobs back to America.

Apple

The back of every Apple device says the same thing: “Designed by Apple in California. Assembled in China” (by Foxconn and Pegatron, ironically, both Taiwanese-owned companies). What Apple doesn’t tell you is that most of the parts in their devices come from neither America nor China.

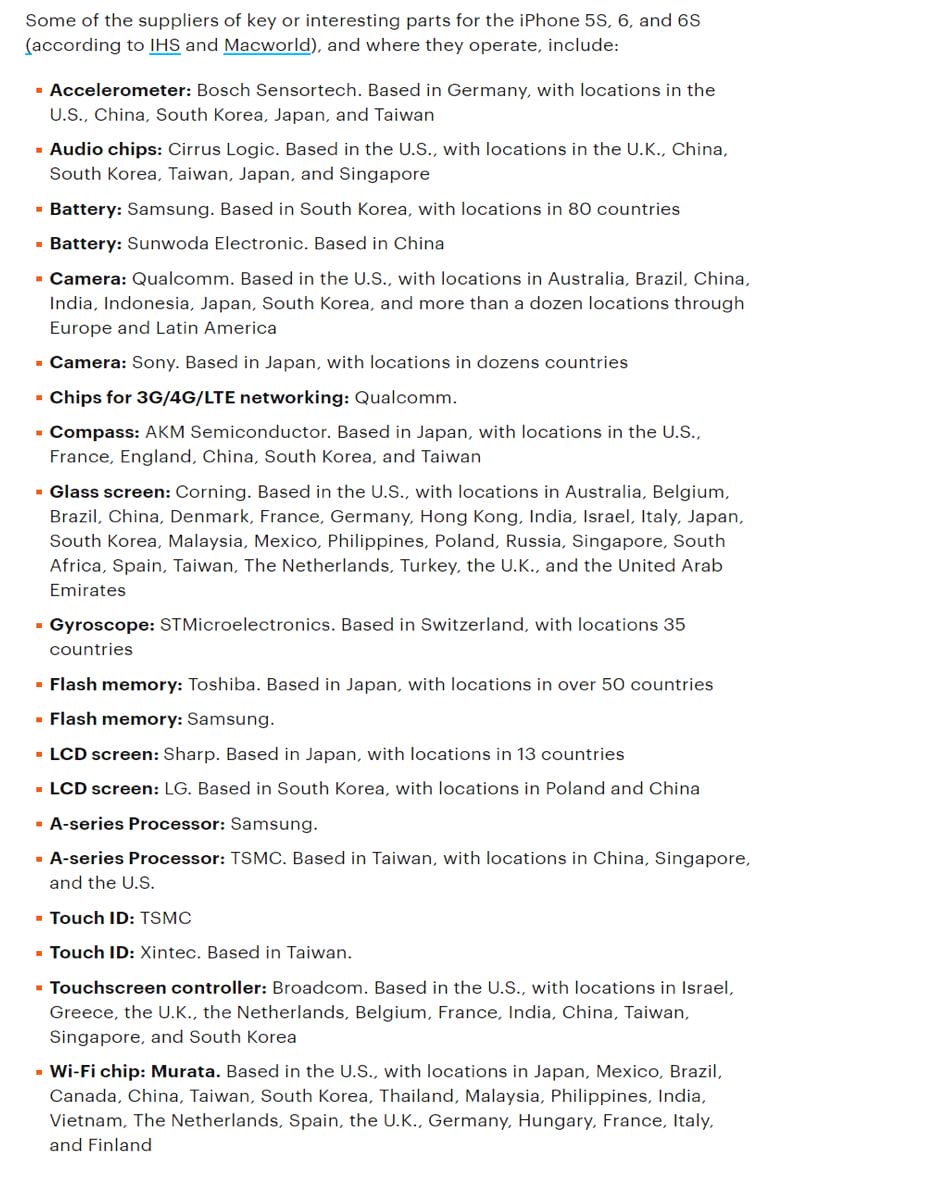

What Livewire.com found when it opened up the iPhone 5S, 6 and 6S to see what was inside were lots of key components from Germany’s Bosch, Korea’s LG and Samsung, and Japan’s Sharp, Sony, and Toshiba—to name only the most prominent companies. There were some American firms on the list too: Broadcomm, Corning, and Qualcomm, but even they do a lot of their manufacturing outside the U.S.

Apple’s supply chain is global. They buy the best components from around the world and assemble them in low cost/high quality Chinese factories. Because their devices are small and light, shipping the final products around the world isn’t prohibitively expensive. And of course, Apple charges a hefty premium for its iconic designs, resulting in large corporate profits, high stock prices, and well-paid employees—in America.

But Apple products sold in the U.S. are “imports” from China, and only add to the gaping trade deficit the U.S. runs with China. So what would happen if the U.S. slapped a 20 percent tariff on Apple imports?

The effective wholesale price of Apple devices in the U.S. would go up by 20 percent. This higher wholesale would either lower profits and stock prices or American consumers would pay more for their Apple devices. Apple would try to sell more iPhones outside the U.S., to avoid U.S. tariffs entirely, reducing competition and quality in the American marketplace.

Apple would only move assembly back to the U.S. if the difference in assembly costs between China and the U.S. and the cost of shipping iPhones from China into the U.S. was less than 20 percent of the wholesale price of iPhones in America. Since average wages in the U.S. are more than five times (i.e. 500 percent) those in China, this is most unlikely.

What about the German, Japanese and Korean high-tech companies from which Apple buys parts? Does the Trump administration really want these firms manufacturing in the U.S.? Maybe, because this would create jobs (think BMW and Toyota). But the real win would be to replace Siemens and Toshiba with American firms. That is a laudable goal, but a blunt 20 percent tariff on imports would not achieve it—because these components are imported by China, not the U.S.

Bottom line: Apple leverages American design genius, low-cost Chinese assembly and the best high-tech parts from around the world to make iPhones and its other devices. A 20 percent import tariff would likely have no impact on this. It would only hurt Apple, its shareholders and/or Americans buying its devices. Indeed, Apple would only try to increase its sales outside America—most notably in China.

Boeing

Donald Trump lauds Boeing as a “made in America, sold to the world” company, creating (and keeping) thousands of good jobs in the U.S. At first blush, this makes Boeing very different from Apple, which explains why the aircraft manufacturer is a poster child for an “America First” economic policy.

The only problem is that while Boeing still does final assembly of its planes in America, it is increasingly sourcing components from outside the U.S.

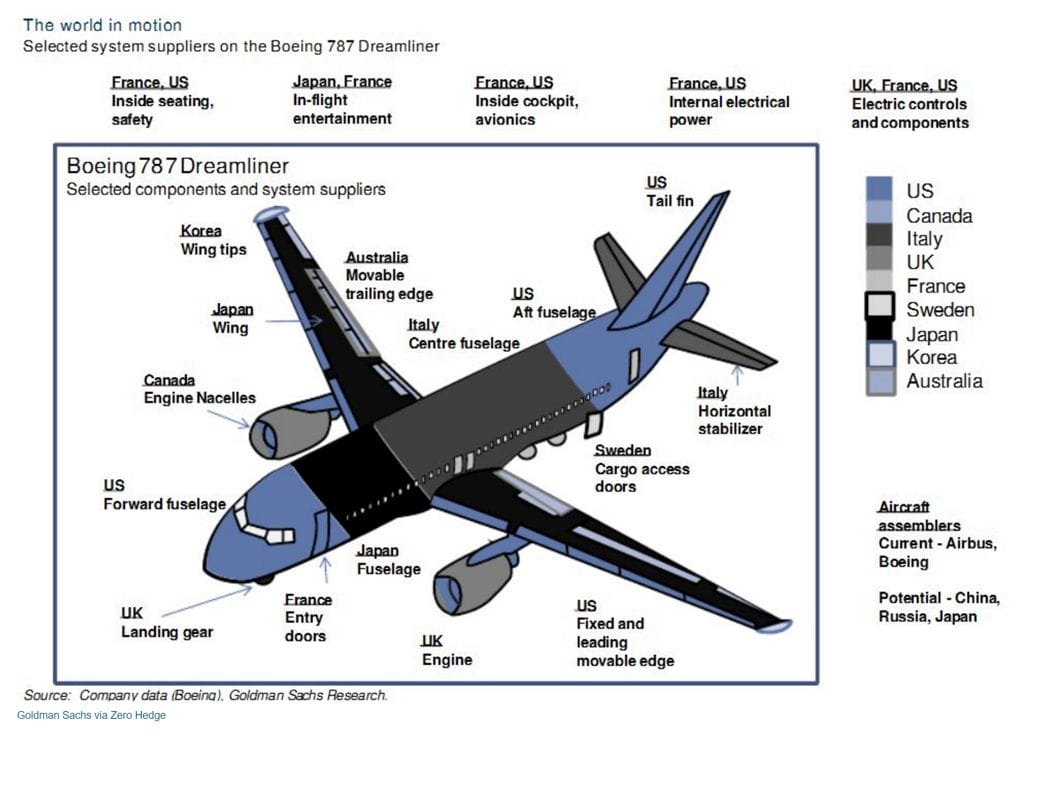

Above is a diagram showing how Boeing’s latest commercial airliner, the 787 Dreamliner, is put together. Dreamliner components are manufactured in eight countries outside the U.S: Australia, Canada, France, Italy, Japan, South Korea, Sweden and the U.K.

Now apply the 20 percent import tariff to the production of the Dreamliner. All the components brought into the U.S for final assembly would be 20 percent more expensive. The cost of producing the plane would go up accordingly. Maybe over time, this would lead Boeing to return to its historic pattern of producing more components of its planes in the U.S.—though it has clearly decided this is not the most efficient way to make Dreamliners.

But over time, the bigger impact of a 20 percent tariff would be to push Boeing production offshore entirely—as in the Apple case. Based on the latest data, the only major American buyer of Dreamliners has been United Airlines. The vast majority of the planes have been sold outside the country.

The Dreamliner has not done well in the biggest airliner market, China. At least part of the reason is that it does not assemble planes in China; its rival Airbus certainly thinks so. Airbus began assembling planes in China more than five years ago. A Trump tariff would only lead Boeing to consider this option more seriously.

Which brings me to my final case.

GM

Much has been made of the fact that American automobile companies often sell cars in the U.S. that they make outside the country in Canada and Mexico. Indeed, this trend in the car industry is a big reason why Donald Trump says he wants to re-negotiate NAFTA—get a better trade deal, and more cars will truly be made in America.

I doubt it. It is certainly true that several GM brands sold in America are manufactured outside of the country. According to Autoblog.com, such iconic American brands as Chevy’s Camaro and Impala are made in Canada, and the Escalade SUV and Silverado light truck are made in Mexico. Some glamorous brands like Corvette are assembled in America, but Corvette engines are made in Canada and its gearboxes are made in Mexico.

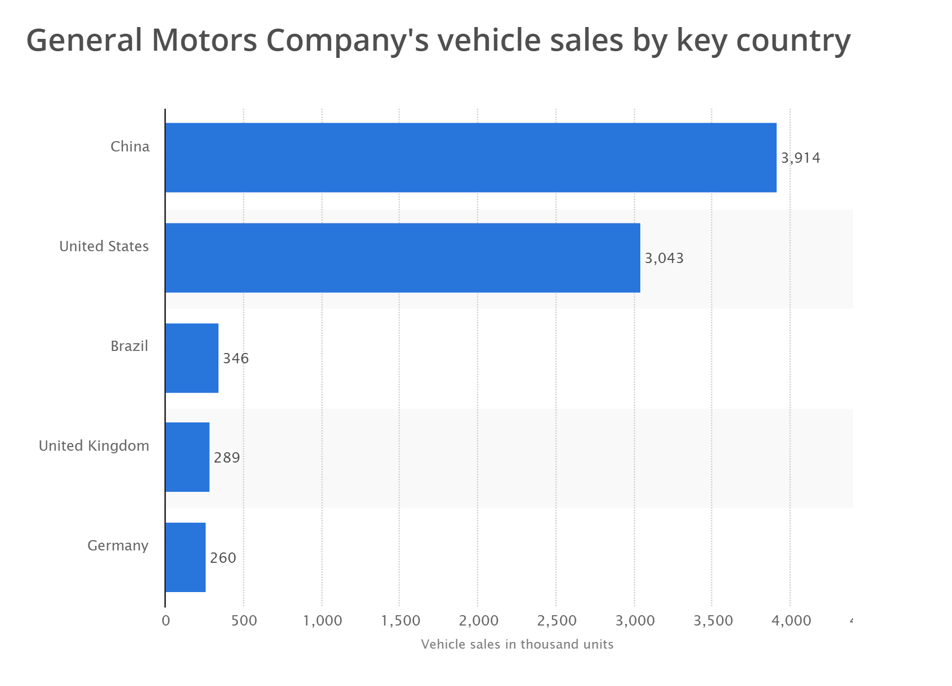

A 20 percent import tariff would no doubt bring some of this production back to America. But that is not the main story where GM is concerned. The graph above from Statista.com shows that GM sold nearly a million more cars and trucks in China in 2016 than it did in the U.S.

That’s a good news story in America, right? You’d think GM and American politicians would be extolling the virtues of this story—“made in America, sold in China.” But they don’t. Because the vehicles GM sells in China are made in heavily automated new factories in places like Pudong, not on Detroit assembly lines. And they are made in a joint venture with the Chinese firm SAIC. GM shareholders are the big winners, not American autoworkers.

A Trump tariff would simply have no impact on GM in China, even though far more production is outsourced there than is the case for Canada and Mexico.

So put it all together and the gaps between the rhetoric and reality on trade protection are glaring:

- Talking protectionism is great politics, but terrible economics.

- Tariffs only work in a world where goods and services are truly made in one country and sold to other countries; today’s global supply chains and distribution networks used by multinational firms are the exact opposite.

- Trump tariffs would be designed to bring jobs and production back to America; their impact would be to push more production offshore to service rapidly growing markets outside America.

- American multinationals are very successful precisely because they leverage globalization; bringing them back home would not only be bad for the companies, it would be bad for America, too.

All this might help explain why the new administration hasn’t yet acted on its tough talk on trade. Let’s hope that where policy is concerned, the silence continues.

Editor’s Note: This post was originally published on Dean Geoffrey Garrett’s LinkedIn page, where he was named an “influencer” for his insights in the business world. Geoffrey Garrett is Dean, Reliance Professor of Management and Private Enterprise, and Professor of Management at the Wharton School of the University of Pennsylvania. Follow Geoff on Twitter. View the original post here.