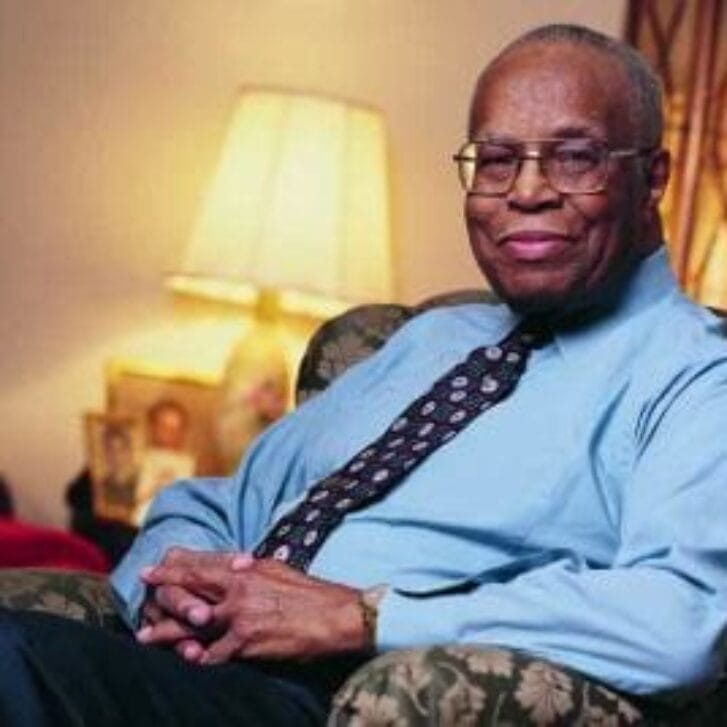

The Campbell Family

Richard, Sr., W’33; Richard, Jr., W’66, WG’68; Alexander, W’98; Doug, WG’03

Richard Campbell was never a start-up king or Fortune 500 CEO. He made some money, but he didn’t come from it. His dad, Richard Campbell, Sr., W’33, sold pharmaceuticals and glass containers, including those curvy bottles that made Coca-Cola taste so good.

The elder Campbell sent his son to public school in Louisville, Kentucky. When it came time to choose a college, the boy narrowed his choices to two very different schools – Wharton and the U.S. Naval Academy.

“My dad gave me one piece of advice,” Richard Campbell, Jr. recalls. “He thought I would feel the discipline constraining at the Naval Academy.”

So Richard Campbell, Jr., W’66 and WG’68, took his Navy ROTC scholarship to his dad’s alma mater. And he says it just might have saved his life.

Campbell finished his MBA owing the U.S. Navy four years of service in exchange for his college tuition. It was 1968, and the Vietnam War was hot. The freshly minted officer volunteered, and was sent to the Mekong Delta, where he worked in operations research and information systems.

His job was to develop strategy for the “Brown Water Navy,” a riverboat force that patrolled the delta’s muddy canals and channels. He says Wharton injected him with a fierce competitiveness that better prepared him for war than perhaps even a military service academy would have.

When it came time for Campbell’s own sons to choose a college, you might say they followed their dad into battle. The third generation of Campbells to attend Wharton includes Alex, who graduated in 1998 and now heads his own Chicago-based wireless media company; and Doug, who just started work on his MBA.

In the following pages, we offer the stories of some of the many families who have sent several generations of sons and daughters to Wharton. These families maintain their connections to the school in different ways. Some, like the Dietrichs, Huntsmans, and Lauders, have memorialized their Wharton traditions in bricks and mortar. Others, such as Taipei’s Koo family, have established scholarships or professorships to celebrate their longstanding associations. And some, like the Campbells, become loyal annual donors and give selflessly of their time. Dick Campbell, for example, served on Wharton’s Board of Overseers.

“Wharton teaches you to survey the marketplace – How you fare is how you fare relative to everyone else,” Campbell says. “That made me probably better prepared for combat than guys that went through the Naval Academy and were trying to relate it to some book.”

When Campbell went to Vietnam, it was the first time since the Civil War that the Navy had conducted riverine warfare. Officers had to invent everything from scratch as their crews patrolled the flat, jungle-lined waterways in iron-clad vessels vaguely reminiscent of ships from the 1860s.

The Mekong Delta’s low-lying marshes and swamp land cover about a third of South Vietnam, with rivers, tributaries and canals criss-crossing everywhere. Constant floods through the territory made roads scarce, leaving the local population to rely on waterways for transport and communication.

The Viet Cong used those waters too, moving troops and materials freely across them until 1966. That’s when the Navy established the River Patrol Force to police the delta, disrupt the Viet Cong and maintain government control over the region.

“Having lived through it, it was a tremendous experience, an experience that you would never get anywhere else,” Campbell recalls of his role.

The experience landed him a position at the Center for Navy Analysis – a primarily civilian research corporation. From there he went on to serve as Henry Kissinger’s executive assistant from spring 1972 through the middle of 1974. “That has got to be the most intense period around,” Campbell says. He was there as Kissinger negotiated arms treaties with the Soviets, made overtures to China, orchestrated the end of Vietnam and won the Nobel Peace Prize.

Then corporate America rang, and Campbell answered. He worked for PepsiCo for 11 years in finance and operations, then served as chief financial officer for PaineWebber, and finally took a spin through two private-equity partnerships.

Throughout, Campbell has nurtured close ties to Wharton. He still reads The Daily Pennsylvanian on-line. And he says his younger son, Doug, is attending a school that has come a long way since he graduated, transforming itself from an institution that was perhaps a little too academic into a truly corporate model that attracts and develops the most competitive talent.

Doug began pre-term classes in August, whipping through math, economics, accounting and finance refreshers in just a few weeks. His early assessment?

“I’m not alone in being somewhat surprised at the amount of work we have so quickly,” he says. That should come as no surprise to his dad, who says “all of us on the board used to joke that we probably couldn’t get in any more.”

The Seaman Family

Morton, W’53, Carl, W’57, Jeffrey, W’84, Jordan, W’84, Dana, W’87

For Jeffrey Seaman, W’84, the seed of personal success sprouted after his family sold its 50-year-old namesake enterprise.

In 1933, his grandfather Julius Seaman founded Seaman’s Furniture, a chain that became a mainstay in home furnishings for the price-conscious middle-class. Sons Morton, W’53, and Carl Seaman, W’57, pioneered the display and sale of coordinated furniture “packages,” and the brothers took the company public in 1985. A year later, they had a successful secondary offering.

But by 1988, after Jeffrey had earned a few years experience, the Seamans sold the family business and Jeff started thinking about what to do next. He knew furniture. He knew sales. But he needed a hook and a location. Family members had signed a “no-compete” agreement for the Northeast when they sold Seaman’s Furniture, so he couldn’t immediately set up shop in the region he knew best.

Florida was the obvious choice. The housing market and job growth were there, as well as an endless stream of “snow birds” looking for a quick and easy way to furnish their second homes.

Many had stretched the American Dream just as far as it would go to get their place in the sun. They didn’t have the time to fuss over throw pillows or the money to hire a decorator. They needed one-stop furniture shopping at an affordable price.

Rooms To Go opened in Orlando in 1991. It was, quite simply, a different way to buy furniture. No more waiting for delivery. No more hunting around town for the right accessories. Rooms To Go gives customers one place to buy all their furniture, coordinating lamps, wall-hangings, rugs and the like. All the merchandise is in stock, and it’s all delivered within days, not months.

Selection includes furniture to suit traditional tastes as well as the more modern-minded. There are damask-upholstered sofas paired with neo-classically scrolled tables, and more streamlined maple pieces accented with brushed stainless steel. “We’re the best alternative without going crazy,” says Jeff. “It’s a formula that just worked with consumers.”

He says the key is keeping the stores small and filling them with a constantly changing selection. Showrooms are backed by huge warehouses holding enough stock that customers rarely, if ever, have to wait. The formula also means Rooms To Go can succeed where other many other furniture outlets fail: the Web. Monthly Internet sales account for only about a day’s worth of the business Rooms To Go does at its brick-and- mortar stores, but it’s a market the company wants to be in nonetheless.

With Jeff as CEO and father Morton’s three-plus decades of experience never more than a phone call away, the business has grown to 80 stores in six states. Annual sales have passed the billion-dollar mark, making it one of the largest, fastest growing furniture chains in America.

“I’m lucky that my dad sold his business, because it forced me into a fresh start,” Jeff says. He’s also grateful for the new father-son dynamic that launching a business engendered: partnership without the emotional baggage of a long-standing family enterprise.

People often ask how that other family enterprise – Wharton – helped develop Rooms To Go. Like Campbell, Jeff credits the school with instilling the competitiveness that readied him to succeed. “It’s like Hong Kong. The city is just bubbling with enterprise, and Wharton’s like that,” he says.

The Baltodano Family

Duilio I., W’39; Duilio J., W’70; Jose Antonio, W’73; Alejandro, W’77

The scent and texture of fresh-picked coffee is in the Baltodanos’ blood; the ribbed evergreen leaves and bright red coffee “cherries” a pivotal influence on the family’s past and future.

Dr. Moises Baltodano earned his MD from Penn in 1893. But he also owned a small coffee plantation in Nicaragua’s lowlands, and spent two or three months a year in London, peddling his crop to commodities traders. By the time son Duilio I., W’39, was ready for college, the call of family business seemed a siren song. Soon, cattle and pig farming, and agricultural imports augmented an empire built, literally, from the ground up.

Grandsons Duilio J., W’70; Jose Antonio, W’73; and Alejandro, W’77, grew up harvesting coffee in the warm Central American sun, their father’s way of introducing them to their inheritance. The three were just coming into their own when that inheritance was shaken by a revolutionary jolt – and it wasn’t the caffeine.

The 1979 insurrection by the Sandinista National Liberation Front brought sweeping economic and political change. The new government confiscated private property and nationalized much of Nicaragua’s private industry. “Different family members, including myself, had to look for new alternatives,” says Jose Antonio Baltodano.

With a Wharton undergraduate degree in hand, he turned to Harvard University for an MBA and in 1982, founded U.S.-based Mercon Coffee Corp. far from the Sandinistas’ reach. The company has since climbed to the top of the industry in marketing, transporting, financing and storing green coffee. Offices in Latin America, Asia, Europe and Africa have successfully tapped emerging supplies from nations like The Ivory Coast and Vietnam.

And when the conservative democracy of Violeta Barrios de Chamorro was established in 1990, the Baltodanos were ready. The family bought back their property from the government and established new coffee operations in the northern Nicaraguan mountains.

The Baltodanos also bought Café Soluble, one of the world’s largest instant coffee producers, and branched into Nicaragua’s entertainment industry by snapping up dilapidated movie theaters and overhauling them.

Today, the challenges may be greater than ever. The coffee business, and soft commodities in general, are not an easy match with the Internet economy. Some importers worry that cyber connections between buyer and seller will sap the middleman’s margin. Their resistance has already spelled the end of at least one Website designed for direct coffee trading. Mercon is taking a different view, looking for ways to fit e-commerce into its business plan.

“The Internet is something that is unavoidable,” Jose Antonio says. “The challenge to this world is to be visionary and to try to forecast how business will change with the new technology that is emerging.”

With that in mind, Mercon has staked a 48 percent claim to InterCommercial Markets Corp., an independent Internet company dedicated to managing on-line trade for various commodities groups – green coffee being the first. Brown Brothers Harriman & Co., the Columbian Coffee Federation, Kraft Foods, and the New York Board of Trade are strategic partners in the venture. So far, the site has about 500 permanent users in 30 countries, and Jose Antonio says the goal is to “make this THE site for the coffee business.”

After all, there’s a legacy to think of for the 20 Baltodano grandchildren. Three are undergraduates at Penn this fall, though none at Wharton. Maybe for their MBAs.

The Wang Family

Wang Xi, WG’47; Lin Jia, W’03

Wang Xi, WG’47, still remembers the words he sang with Wharton classmates at graduation ceremonies more than half a century ago: “Hail! Pennsylvania! Noble and strong; To thee with loyal hearts we raise our song Swelling to Heavens, loud our praises ring! Hail! Pennsylvania! Of thee we sing!”

The melody rings through his mind after all these years, a memory of relatively carefree days – utopia, no doubt, compared to what awaited him back home in Shanghai in the late 1940s. “I murmured one or two lines in my dream, when we were in those terrible days,” he recalls in a note to his granddaughter, Lin Jia, now a junior at Wharton.

The professor’s words about those times are sparse. He was secretary of the Chinese Students Club in Philadelphia in 1945, and later president. He became engaged to and married his wife there, 54 years ago. He remembers dances and other cultural activities at “the club,” an International House where Chinese author Lao She once gave a “wonderful lecture to the students and professors.”

“It was a great time for him and my grandmother,” Lin says. “He met many great friends and acquaintances … but he really wanted to go back and do something for China.” He was doing just that as a professor at Fudan University when the Cultural Revolution overran his homeland. It’s a period the professor does not mention directly, one his granddaughter explains as “a pause” in his long and productive professional life.

But fast-forward and it’s clear the professor overcame whatever difficulties the People’s Revolution brought. He has been a banker, insurance executive, consultant, and educator. Past titles include president and CEO of Hai Yu Company Ltd., president of the Shanghai Institute of Business Administration and vice president of the Shanghai Office of the General Reinsurance Corp. The People’s Republic of China also recently named him the Distinguished Scholar of Outstanding Contribution. Now, as honorary president of Shanghai’s Wharton alumni club, he says his goal is to “make Wharton the most famous school in China.”

So it should come as no surprise that Wang, like Dick Campbell’s father, had a piece of advice for his granddaughter when she began looking at colleges: Why don’t you think about Wharton?

For a teenager more interested in English and American literature than economics and accounting, the suggestion might have seemed strange at first. But the more she looked, the more it seemed Wharton might offer something she needed, but hadn’t immediately known to look for. “It offers a world view,” she says, “Students can gain a different perspective on an issue … After a while you see that the business world is just a microcosm of the world in general.”

This year, between mentoring responsibilities and time spent with her Christian fellowship group, Lin plans to declare her major in finance or marketing, a degree she hopes to put to use in China one day. For although she was raised as a permanent U.S. resident – the daughter of a one-time visiting scholar who stayed here – Lin says a part of her belongs across the Pacific. “I’ve kind of grown up with China as a part of my heart,” she says. “China would definitely be a place where I would go and pursue opportunities.”

The Hovnanian Family

The Hovnanian clan traces its roots to Armenia, an embattled land the family fled for Baghdad in 1914. Not such a good decision, says Ara Hovnanian, a native-born Iraqi whose father brought him to the United States in 1959 to join three uncles.

The Hovnanian clan traces its roots to Armenia, an embattled land the family fled for Baghdad in 1914. Not such a good decision, says Ara Hovnanian, a native-born Iraqi whose father brought him to the United States in 1959 to join three uncles.

Ara’s father was the final arrival in America, and together the four immigrant brothers started a home-building company, a baby-boomer of a business through and through. The firm grew steadily for a decade, matured into adolescence during the turbulent late 1960s, and then split into four separate entities, each run by a different brother.

“They all wanted to be president,” says Ara Hovnanian, W’79 and WG’79, president and CEO of K. Hovnanian Enterprises. His father, company chairman Kevork Hovnanian, built K. Hovnanian with his cut of the brothers’ organization.

Together, Ara and his father have coaxed their own fledgling firm to adulthood by tracking – who else? – baby boomers. In the 1980s that meant building entry-level condominiums and town houses for the newly prosperous yup-pies who defined the decade. Later, as boomers began having families, Hovnanian Enterprises expanded into larger and higher-end homes. And now, as the first boomers have passed 50, the company has started building “active adult” developments for retirees and empty nesters looking for convenience and recreation.

Ara had to put his joint degree to work quickly to keep pace. Five months after graduation, his father’s second-in-command resigned and Ara was tapped. He and his dad took the company public in 1983. Their projects now blanket New York, New Jersey and Pennsylvania, and are beginning to dot spots as far west as Texas and California. Their strength remains in the mid-Atlantic region, where Hovnanian is the largest homebuilder. Annual revenues top $1.8 billion.

It’s easy to see why when you tour a Hovnanian home. Palladium windows flank the fireplaces, custom woodwork gleams. Many of the rooms are so generously proportioned even a baby grand piano doesn’t seem to take up much space.

Far from causing ill will, Ara Hovnanian says, the breakup of the company his father and uncles founded assured family ties would come before competition. Uncle Jirair Hovnanian, W ‘52, runs J. S. Hovnanian & Sons with sons Stephen and Peter in New Jersey. Cousin Edele, W ‘81, runs H. Hovnanian Industries, a retirement-home and assisted-living building business started by a third of the four original brothers. The fourth family branch is in wireless communications.

Ara’s children, 13 and 11, are still a bit young to be thinking about college, much less an MBA. But when they are ready, he says, he hopes they’ll consider Wharton. “It without a doubt was a great preparation for me,” Ara says. “I’m thankful for the education we had.”