The Wharton Education Network (WhEN) was founded last year by Sergio Abramovich, WG’99. The goal of WhEN is to be a network for ideas and knowledge that will help its members to better run their companies, to identify new opportunities, and to obtain better results from their investments in the education market. Abramovich, who has a background in online education in Hispanic and international markets, is the Director of Business Development for Latin America at DeVry Inc.

Previously he worked in New York at FUNIBER, an alliance of Spanish and Latin American universities that provides online education in Spanish and Portuguese, and before that at the Open University of Catalonia, the largest online university in Spain and Latin America. After moving back to New York earlier last year, he decided to launch the affinity group within the Wharton Club of New York.

“There is a relatively large group of Wharton alumni currently involved in the education industry; however, there was no group or network in which we could exchange ideas, promote the education industry, learn from each other, and identify new business opportunities,” he said. “Wharton has an amazing tradition in the field and I believe that the entire Wharton community should continue working towards developing the education industry.”

Abramovich believes the group serves an additional purpose in terms of filling in a missing niche. “Other top MBA schools offer several courses and even majors in education, but Wharton does not,” he said. “People from all over the country have expressed interest in participating in WhEN which reinforces the point that the Wharton community is looking for different ways to promote the education industry.” We should keep encouraging CDP and the different students clubs at Wharton to reach out to the education companies and to increase the rate of hiring of Wharton grads in the industry. The group has held four events already.

Speakers included, Michaël Bijaoui from MESA, Steven Kemler from Conversion Partners, David Moore from Corinthian Colleges, Kristin Green from Eduventures, Suzanne Roddis from the IFC World Bank, Robert Lytle from Parthenon, Sergio Abramovich from DeVry, Andy Kaplan from Quads Partners, and Mark Murtagh from Liberty Partners. The topics addressed were M&A in Education, Online Education,International Markets, and Future Trends in the Education Industry.

More than 25 people representing different sectors of the education industry attended each of our previous events. “We had investors, providers, K-12 companies, higher education, online education, consultants, private equity partners and bankers,” Abramovich said. “Our trademark is the highly interactive session. Presentations started at 6:30 p.m., and people asked so many questions that we always stayed until 9, having some wine and snacks, talking about the education industry, trends, and business opportunities.” Events are open to all Wharton alumni who are employed in the education sector or want to invest in it.

Sergio Abramovich,

WhEN@whartonny.com

A Club Gives Back: Wharton Aerospace

On February, 23, 2007, more than 165 alumni and invited guests with shared ties and commitments to the aerospace and defense industries returned to Jon M. Huntsman Hall to participate in the Wharton Aerospace Conference 2007. Keynote speakers included Goodrich Corp. CEO Marshall Larsen, EDO Corp. CEO James Smith, and Deputy Undersecretary of Defense for Industrial Policy William Greenwalt.

Since the Wharton Aerospace Community is an industry-based affinity group, its organizers felt the Wharton campus is a logical place to conduct its events. This year’s event marked the club’s fourth annual meeting. Since its founding in 2003, one dozen CEOs have spoken at its events, and several dozen other CEOs have participated as panelists and audience members.

Historically, the club charged participants registration fees to cover conference variable costs, while seeking sponsorships from outside companies to cover fixed costs. For 2008, the club will shift its strategy. “For our past events, we simply sought to cover our expenses. What we found is that enough companies are willing to sponsor our events, which has the potential to create a surplus,”says Wharton Aerospace Co-President

Michael Langman, WG’98, of PCE Investment Bankers. “For 2008 we will increase the number of event sponsors and turn the proceeds over to The Wharton School in appreciation of the tremendous support we receive from the Alumni Affairs staff in organizing our events”. “We made a modest $1,000 profit last year, which we donated to the school,” adds Co-President Ellen Chang, WG’98, of Northrop Grumman. “The surplus from this year’s conference will be donated to the Lewis Platt Doctoral Fellowship in Business Ethics. And for 2008, we are shooting for a significantly larger sum.”

“Even though Michael and I graduated almost ten years ago, our relationship with the school continues to benefit our alumni in ways we never even considered when we were going through the MBA program,” Ellen said. “This is our way of saying thank you.”

Michael Langman

1.319.431.1282

Michael.Langman.wg98@wharton.upenn.edu

Club News in Brief

The Wharton Club of San Diego has re-energized with a series of events, including a happy hour at Harry’s Bar & Grill in La Jolla on July 12 and a September wine and cheese event at the home of Rick Thompson,WG’96, in Rancho Santa Fe. In other cultural news, Laura Robinson, WG’92, a new board member of the San Diego Chamber Orchestra, has invited club members to a pre-season talk on August 13 with the artistic director of the San Diego Chamber Orchestra, Jung-Ho Pak. She is also planning an IvyHour/San Diego Spotlight hosted event for the San Diego Chamber Orchestra January Concert in Rancho Santa Fe.

On May 8, 2007, the Wharton Carolinas Club hosted a panel discussion entitled “Trends in Sports Business.” The panel consisted of Professor Ken Shropshire, Director ofthe Wharton Sports Business Initiative; Ray Bednar, Strategic Marketing Executive from Bank of America; and Mike Gminski, former NBA and Duke University basketball player and now well-known basketball commentator.

Following a bagel breakfast during which attendees schmoozed and networked, the panelists gave their insights into trends influencing sports business. Questions and answers followed. Wharton Carolinas events are characterized by quizzes and contests.

Attendees had been asked to predict the winner of the Wachovia Golf Championship, which ended on May 6. Jamie Dunn, WG’06, using Wharton style forecasting and computer modeling techniques, correctly predicted that Tiger Woods would win by two strokes! He was awarded tickets to next year’s Wachovia Championship. The next event planned was a summer family picnic held in mid-July.

***

The Wharton Club of Southern California has had an amazing summer, with annual dinners in L.A. and Orange County, a fantastic Media and Entertainment Forum, and Wharton/Penn Days at Angel and Dodger Stadiums. The club met many of the summer interns and is gearing up for the admissions season. Zafar Khan, WG’98, will be taking over as president for Wharton So Cal from Meesh Joslyn Pierce, W’93, WG’98, starting in January 2008. He has successfully led the club’s C-Circle initiative, getting Wharton C-level executives to meet regularly to discuss high level business matters and act as a sounding board for one another.

On May 17, 2007, the Wharton Club of Mexico City hosted Leonard M. Lodish, the Samuel R. Harrell Professor and Professor of Marketing, for a speaking engagement on how Mexican companies can use global entrepreneurial marketing. Lodish is also the founder and senior director of Wharton’s Global Consulting Practicum. The event was organized with the support of the Wharton Alumni Affairs office. More than 50 Wharton and Insead alumni attended the discussion and cocktail hour.

***

The Wharton Club of Spain has hosted four events during the second quarter of 2007. First was lunch with Felipe Oriol, WG’74, chairman of Corpfin Capital and Chairman of Fundación Empresa y Sociedad. Felipe was founder of the Wharton Club of Spain back in the 1980s. He has been a main actor in the private equity industry in Spain since 1989, and in 1995 he co-founded the first Spanish entity of businesses to promote corporate social responsibility. More than 20 alumni gathered around the table at el Club Financiero de Madrid to discuss private equity and CSR.

The second event was lunch with Steven Winegar, CEO of Restauralia and founder of Grupo ZENA, one of Spain’s largest food service chains. Discussion ranged from entrepreneurship, to private equity from the point of view of the manager, to strategic issues in the food service industry.

The Club hosted a new panel format with a group of four members from leading head hunting firms. Pedro Goenaga, WG’85, Ramon Gomez de Olea, WG’97, G’97, Pilar Girón, WG’92, and Javier Anitua, WG’91, guided attendees through key issues for career planning.

Finally, the Club hosted a reception to Lauder students visiting Madrid as part of the Spanish immersion program. These students were in Mexico and Spain for six weeks to improve their Spanish skills through a combination of formal classes at local universities and cultural events. Club members helped arrange company visits and arranged the reception so the students could meet with Spanish alumni.

***

The Wharton Club of Japan, in conjunction with Fuji Xerox, held a luncheon meeting with Professor Michael Useem on April 24, 2007, as a part of The Wharton 125th Anniversary World Tour. More than 50 people, including newly admitted students from the class of 2009, attended the very successful meeting

On May 18, 2007, the Wharton Club of Japan General Meeting was held. Guest speakers included Professor Stephen Kobrin and MBA Admissions Director Thomas Caleel, with more than 110 people in attendance. A December year-end event and welcome party for the class of 2007 is in the works.

Wharton Connections in Action

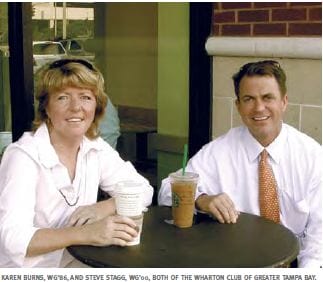

Karen Burns, WG’86

When Karen Burns attended her 20-year Wharton Reunion in May 2006, her ship had literally just come in. She had just finished up her fifth stint as a member of the executive team for Semester at Sea, stepping off one boat and onto another — the 110 foot yacht of her classmate George Hall, who hosted a Friday night cocktail party on the Delaware River to kick off the Reunion.

“Everyone asks what you’ve been doing lately, and I had a pretty unusual answer,” she says. “I spoke with Troy Taylor (W’80, WG’86), who started the Algon Group, and he asked what I was planning to do next.”Algon Group is a financial advisory firm focused on complex and distressed situations.

“We’re a small firm of very senior people, and at the Wharton reunion, it was the right people,” says Troy, who is both president and founder of the Algon Group. “I talked to Karen, and she was doing consulting on her own. It seemed like a good fit, so I called her three or four days after the Reunion.”

By the summertime, she had opened a Tampa, FL, office as a managing director for the boutique financial advisory group that already had footholds in Atlanta, Birmingham, AL, and Philadelphia, the home base of Paul Rubin, WG’84, a fellow managing director and another Wharton alumnus. Karen appreciates the broad expertise of her colleagues. “With Algon Group, there is always the right experience,” she says. “We’ve covered every market, every job description. With our 20 year careers, if it needs to be done, we’ve done it before.”

Karen has become a strong advocate of the Wharton network, and was recently named President Elect of the Wharton Club of Greater Tampa Bay. “It’s been a tremendous resource for me. Working from my home office for Algon Group, I never know what the demands of a project will be—it could be any market, any geography. Right now I’m working on a $15 million real estate deal, so I reached out to Steve Stagg (WG’00, current president of the Wharton Club of Greater Tampa Bay). He’s CFO of Harrod Properties and used to work in investment banking, so the connections through him have helped with the project.”

Troy cites another example: the Algon Group was hired as financial advisor to a $5 billion company in Georgia in the midst of making a difficult acquisition. Says Troy, “A company that size can hire anyone, so for them to hire a small boutique firm shows that we have extra credibility. One of the things that may have helped us is that the CEO is also a Wharton guy.” Karen explains, “I know I have confidence when I reach out to a fellow alumnus. There’s a comfort level from the shared connection, and it gives you boardroom credibility. My Wharton credentials have always been a door opener for me.”