CEOs and Their Companies Profit from Executive Stock Ownership

Should a Chief Executive Officer be required to own stock in his or her firm? The age-old question of whether or not to force CEOs to buy into their company continues to generate significant debate, with much of the discussion centering on whether standard equity ownership by senior management and external board members is too low to motivate appropriate financing and investment decisions that increase shareholder value. In response to this and other criticisms by shareholders and corporate governance activists, a number of companies have adopted target ownership plans.

Will the Glaxo-SmithKline Merger Be Good Therapy?

Will the Glaxo-SmithKline Merger Be Good Therapy?

The proposed acquisition of SmithKline Beecham by Glaxo Wellcome – in a stock swap valued at $75.7 billion – may be creating the world’s largest pharmaceuticals company, but the question remains: Is it worth the effort? Wall Street in general was clearly not enthusiastic about the deal. On Tuesday, January 18, the first business day after the announcement of the merger on Monday, both company stocks took a beating in London and the U.S.

The Patient Died: A Post- mortem on America’s Largest Nonprofit Healthcare Failure

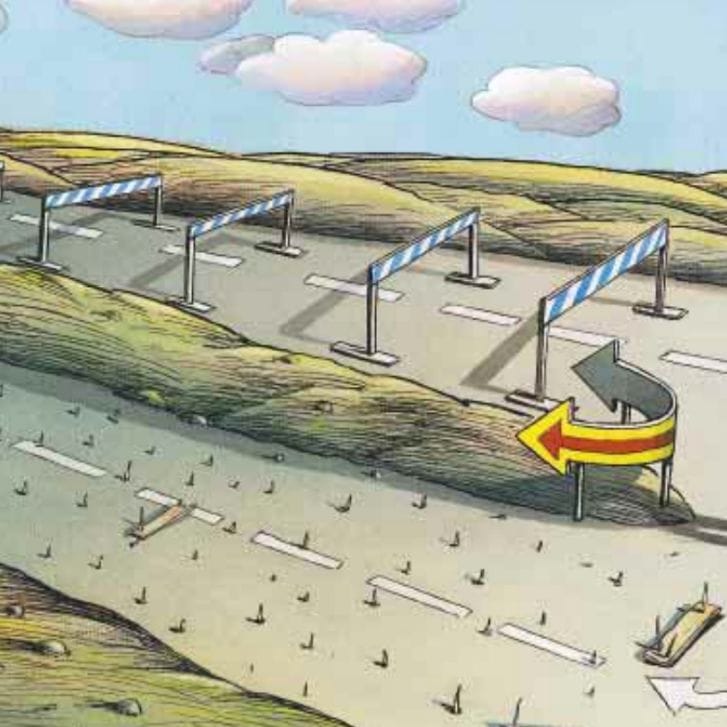

When the Allegheny Health, Education, and Research Foundation (AHERF) declared bankruptcy on July 21, 1998, it left behind $1.3 billion in debt, 65,000 creditors and enough bile to blanket the East coast. The bankruptcy meant the dismantling of the largest statewide integrated delivery system in Pennsylvania. It led to thousands of layoffs in Philadelphia’s healthcare community and the sale of six local hospitals to an out-of-state, investor-owned corporation. And it called into question a strategy – popular among academic medical centers in the mid-1990s – of acquiring, at almost any cost, physicians, researchers and medical facilities in order to corner a market that has turned out to be remarkably elusive.

When the Allegheny Health, Education, and Research Foundation (AHERF) declared bankruptcy on July 21, 1998, it left behind $1.3 billion in debt, 65,000 creditors and enough bile to blanket the East coast. The bankruptcy meant the dismantling of the largest statewide integrated delivery system in Pennsylvania. It led to thousands of layoffs in Philadelphia’s healthcare community and the sale of six local hospitals to an out-of-state, investor-owned corporation. And it called into question a strategy – popular among academic medical centers in the mid-1990s – of acquiring, at almost any cost, physicians, researchers and medical facilities in order to corner a market that has turned out to be remarkably elusive.

Information Technology: How It Affects Work Practices and Wages

We have only to pick up the daily newspaper to read about the creation of yet another fabulous fortune based on technology. But even as high-tech millionaires proliferate, there has been considerable debate about the impact that technology has had on wages of those who use technology in their daily work practices. Some argue that technology has eliminated jobs and had a negative impact on wages, while others counter that it has improved productivity and boosted wages. Wharton’s Chip Hunter and John Lafkas recently completed a study in which they examined information technology, work practices, and wages for the job of customer service representatives (CSRs) in bank branches.

We have only to pick up the daily newspaper to read about the creation of yet another fabulous fortune based on technology. But even as high-tech millionaires proliferate, there has been considerable debate about the impact that technology has had on wages of those who use technology in their daily work practices. Some argue that technology has eliminated jobs and had a negative impact on wages, while others counter that it has improved productivity and boosted wages. Wharton’s Chip Hunter and John Lafkas recently completed a study in which they examined information technology, work practices, and wages for the job of customer service representatives (CSRs) in bank branches.