Richard Shell had arranged for a cab driver from his suburban neighborhood to pick him up at Philadelphia International Airport when his flight landed at midnight. He’d learned from hard experience that some city cab drivers don’t know their way around the suburbs, a reality that had led to some steep cab bills and long, winding rides home.

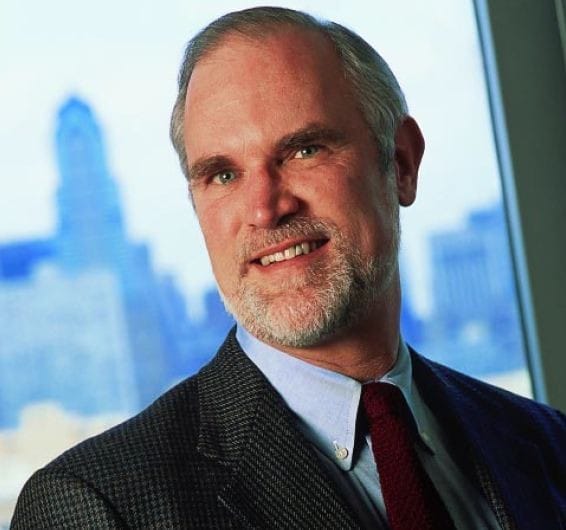

He had been taken to the airport by the owner of a small, suburban fleet of cabs, who said he would be waiting in the baggage claim area upon Shell’s return. “To my delight, there he was as I came down the elevator,” says Shell, a legal studies professor. “But then things got complicated.”

The driver took Shell outside and pointed to a spot across a couple of roads and traffic islands. That, he said, was where Shell was to wait. “But where’s the cab?” Shell asked. The driver explained that the city cab companies had long ago negotiated an agreement with the airport – an agreement designed to make it very difficult for suburban cabbies to operate efficiently there. “First, I have to meet you,” the driver told Shell. “Then you have to walk all the way over to Zone 6. Then I have to go back to the limo waiting area to get the cab. Then I can pick you up.”

This anecdote, Shell explains in a new book, is a telling example of the way businesses often encounter the law – not as a lawsuit or regulatory proceeding but as a part of someone else’s competitive strategy. “Incumbents can’t ban the competition,” Shell writes. “But they can use laws and regulatory processes to add cost and inconvenience to their competitors’ products.” It’s called competitive legal strategy – a high-stakes game in which some businesses make the rules, while others are forced to operate within those boundaries. “The one thing I saw that was missing in the practitioner literature was how business people should think of law as a tool of corporate strategy – that is, what are the ways that businesses can use legal tools, whether it’s litigation, lobbying, or regulations, to help them gain or protect a competitive advantage,” says Shell, the Thomas Gerrity Professor of Legal Studies and Management and former chair of the Legal Studies Department. “There’s a huge amount of this activity going on, but there’s almost nothing written about it other than in specialized academic works.”

How laws make winners of some firms and losers of others, and how business leaders manage, defend against, and gain a competitive foothold from the law, is the subject of Shell’s book, tentatively titled Make the Rules or Your Competitors Will. Under contract with Crown Publishing and scheduled for publication in early 2004, the book is a fresh angle in a market crowded with legal writings, from diatribes against business regulation to treatises that suggest cozy, corrupt partnerships between business and government.

“What was missing from these world views is the way the political system actually works when it’s adjusting to the economic reality of business,” says Shell. “It’s a forum in which businesses act as an interest group but just as often are fighting each other.

Shell has also authored the award-winning Bargaining for Advantage: Negotiation Strategies for Reasonable People (1999, Viking Press/Penguin Books), a book read in many Wharton School negotiation classrooms and praised by both students and executives for providing a new and useful view of a not-so-new subject. In his latest book, his message is simple: businesses need to understand enough about the law to integrate it into daily strategic thinking.

The Disney Company, for example, has managed to continually extend its copyright protection on its storied cartoon characters, the source of much of the firm’s profits, by lobbying Congress each time an older character’s protection is set to expire. Pharmaceuticals such as Pfizer and Merck, meanwhile, religiously scrutinize patent laws and FDA processes with the goal of tipping the balance away from generics and toward brand-name products.

And despite widespread perceptions to the contrary, Shell argues that this legal maneuvering is not rocket science and is not just for large and resource-rich organizations. Business leaders overestimate the difficulty of making legal strategy a competitive tool, giving those who gain this knowledge a genuine competitive edge. “Lawyers, litigation, regulatory agencies, lobbying, and legislative reforms are powerful opportunities, and threats, in the right hands,” Shell says. “I don’t think anybody – including the Supreme Court justices – fully understands the law. I think most lawyers and judges take each case and try to do the best they can. In just this way, executives can grasp a great deal about the legal dynamics of certain situations when the success of their business is at stake.”

What are some key legal insights Shell believes businesses can’t afford to ignore?

● First, the merits of a legal claim or public policy argument are only one aspect of a successful legal strategy. “You can have a great case and still lose in the marketplace if you fail to properly understand the strategic environment you are in and the strategic goal you’re trying to accomplish,” he says. New companies with an innovative product entering the market space of a very powerful incumbent, for instance, often find themselves on the receiving end of lawsuits. The litigation may have little merit, but young firms often lack the resources to mount a defense. “So they end up having to settle the case, or just drop out because their funding dries up,” Shell says.

● It’s also critical to understand that most legal strategy decisions are really business decisions in disguise. Whether and when to settle a case, for instance, is driven more by strategic considerations, Shell says, than legal ones. A business might have a great legal case, but it chooses not to litigate because the entity that has wronged it is its biggest customer. “Or you may be involved in litigation in which you have a legitimate legal claim, but you’ve only got so much money, and if you continue with the litigation, you’ll have to drop your marketing program. So you settle the case,” Shell says.

● Similarly, firms with deep pockets and good market positions are formidable legal opponents, even when they have a weak legal case. “When you’ve got a strong strategic position, you are able to bring other pressures to bear to win a favorable outcome in a legal dispute. Many of these pressures go beyond financial resources, such as leverage with suppliers or customers, that enable you to really lean on your opponent.”

● Access to sympathetic legal decision makers – particularly regulators and legislators – is “worth its weight in gold,” Shell says. “Smart businesses invest in this long before they need it. Microsoft did not, and look what happened to it. Before the government brought its antitrust case, Bill Gates had one lonely lobbyist based in a Washington, DC suburb. It made political contributions of a little over $100,000 per year. Now Microsoft has a 15-person Washington staff and is one of the largest political contributors in the high-tech industry.” Even small businesses, says Shell, can cultivate clout on a local level with city councils and chambers of commerce.

● In legal disputes, the public’s perception of who is right and who is wrong can be pivotal. Winning in the court of public opinion, Shell says, can be just as important as winning in the courthouse. Henry Ford, for example, founded Ford Motor Co. in 1903 and was sued within six weeks by an association of car manufacturers that had, to date, quickly put new market entrants out of business based on a patent it held on the automobile. The group was particularly vehement in its opposition to Ford, who wanted to make an affordable automobile for the masses. Ford took on the group in a very public fight, defeating its initial attempt to win an injunction against him. For eight more years, he litigated to defeat the patent, casting himself as a Robin Hood of the car business. “By the end of that lawsuit, he was a national figure and a hero,” Shell says. “Millions of Americans favored the little guy fighting the big guy, and in the early 1900s, this was a big political issue not just with the automobile, but with steel and banking and oil. Ford won hearts, minds, and market share and became an enormously powerful icon of the American spirit.”

Another key to Shell’s approach to legal strategy is his focus on playing a skilled defense when a competitor breaks the rules. He acknowledges that there will always be businesses that deftly abuse the law to advance their own agenda but says that one firm’s illegal act never justifies another lowering its standards. Nonetheless, businesses need not be passive in the face of bullying adversaries.

Antitrust claims, for instance, can be brought against sizeable bullies. “These are some of the claims that companies like Sun Microsystems and Netscape are now bringing against Microsoft in the wake of the Microsoft verdict,” Shell says. “The private firms get to benefit from that verdict and can sue without having to prove an antitrust violation because the government did that already.”

These rivals, of course, were instrumental in the government’s decision to bring its massive antitrust case against Microsoft in the first place. They lobbied heavily at the Justice Department and in Congress precisely for this reason, says Shell – so that they wouldn’t be forced to shoulder the burden of a costly antitrust case against a wealthy and resource-rich opponent. The Microsoft case, thus, is an example of less-powerful firms using both regulatory and lobbying avenues to help them reclaim their competitive advantage and then using litigation to collect money based on their regulatory success.

“Abuse of process” is another way organizations can fire back at companies that have brought frivolous lawsuits in an attempt to delay a product launch or impose crippling costs, says Shell. Suppose that a young company is days away from launching an IPO when a powerful rival files a lawsuit claiming intellectual property infringement.

“The claim is bogus, but all that hits the street is that a little firm is sued by a big gorilla, the investors become worried about the IPO, and the little firm loses funding. What can the firm do? They can sue for abuse of process, claiming that the litigation was like a physical assault and caused damage – lost opportunity to go to market, lost profits from sales that could have taken place had they gotten the financing.”

From Mediation to Corporate Law

Richard Shell brought a rich set of experiences with him when he came to Wharton. He counseled poor families as a social worker in the ghettos of Washington, D.C., studied meditation in Buddhist monasteries in Sri Lanka and South Korea, sold insulation door to door in his home town of Lexington, Virginia, and worked as a corporate attorney in Boston.

His 16 years at Wharton are the longest he has ever stayed in one place. He was raised in a military family and describes his childhood as peripatetic, having moved every year his first six years in school. “The good part of it was that I got to meet a lot of new people and see a lot of different parts of the world,” he says. “The bad part was that I was moving around all the time, so I suffered from a certain rootlessness. But I have come to think of my early life as a source of strength. I’ve always found it easy to get along with people and get to know them quickly. I never felt overly rooted in one place or another, so I was able to move with my career.”

By the time he was ten, Shell’s father, a general in the Marine Corps, was running major Marine bases, a legacy that Shell says is not unlike being the son of a CEO. “You get introduced in public a lot as this person’s son. That has its pluses and minuses – the plus is you feel important, but the minus is that it’s hard to get out from under the shadow of someone who is a great deal more important. In the end, my father and I had a falling out over the Vietnam War when I became a Conscientious Objector. But we made up later and became very close.”

Shell earned his BA in English at Princeton in 1971. To fulfill his obligation as a C.O., he became a social worker and housing relocation counselor in the ghettos of Washington, DC, visiting families who lived in condemned housing to help them find other housing alternatives. “Working in the ghettos was a pretty rough experience,” Shell says. “It was the real world. Far, far from Princeton.”

From there, he spent several years traveling the world alone, “trying to figure out what to do,” seeing many places most travelers can’t or won’t visit today – Iran, Afghanistan, Pakistan, Sri Lanka, Nepal, among others. A passionate interest in religion took him to many “holy places,” from Jerusalem and the area around the Sea of Galilee to various Hindu, Buddhist, and Moslem shrines in India. He returned to the U.S. and decided to go to law school at the University of Virginia in the early 1980s.

From the beginning, he chose a law school track that would allow him to teach. “I really love teaching,” he says, admitting that he was the kind of kid who always raised his hand in class. “Some professors love their research and teach because they have to, and some love to teach and do their research so they can teach. I’m in the middle.” Faced with a crowded teaching market in law schools, he practiced law for a few years in Boston, then began his job search in both law schools and business schools. A query from Wharton in 1986 seemed a good fit for Shell and his wife Robbie, managing editor of Wharton’s online business journal, Knowledge@Wharton, whom he met at a Grateful Dead concert during their senior year at Princeton. The Shells bought a historic townhouse near Penn on a quiet University City street, where they lived for more than 15 years and raised their two sons, Ned, 13, and Ben, 20, before a recent move to the suburbs.

Despite settling down at Wharton, Shell’s wanderlust, to some degree, remains. Since their youngest son was 6, the family has traveled frequently to Europe, Mexico, and South America. “I have dreams of visiting China, Tibet, and Africa, where I’ve never been,” Shell says. Consulting work for firms such as Citibank, Merck, General Electric, and Johnson & Johnson, as well as speaking engagements, also keep Shell traveling all over the world.

Aside from Wharton’s MBA and undergraduate courses, Shell has also taught in Executive Education, WEMBA and the Law School and has won teaching awards in all of Wharton’s degree programs. Shell’s other research has touched on topics from the perils of e-mail as an electronic bargaining tool to a recent paper, pegged to the Enron scandal, on the role of bargaining style in public company audits. His latest book, like his first one, he says, would likely have never seen the light of day had he landed in a law school instead of at Wharton. “My work is all about corporate problem solving and strategy,” he says. “And the subject of strategy isn’t taught or discussed in law schools. I have had the good fortune to be surrounded by top-notch business thinkers at Wharton and that has really shaped my thinking about the way the real world of business works.”