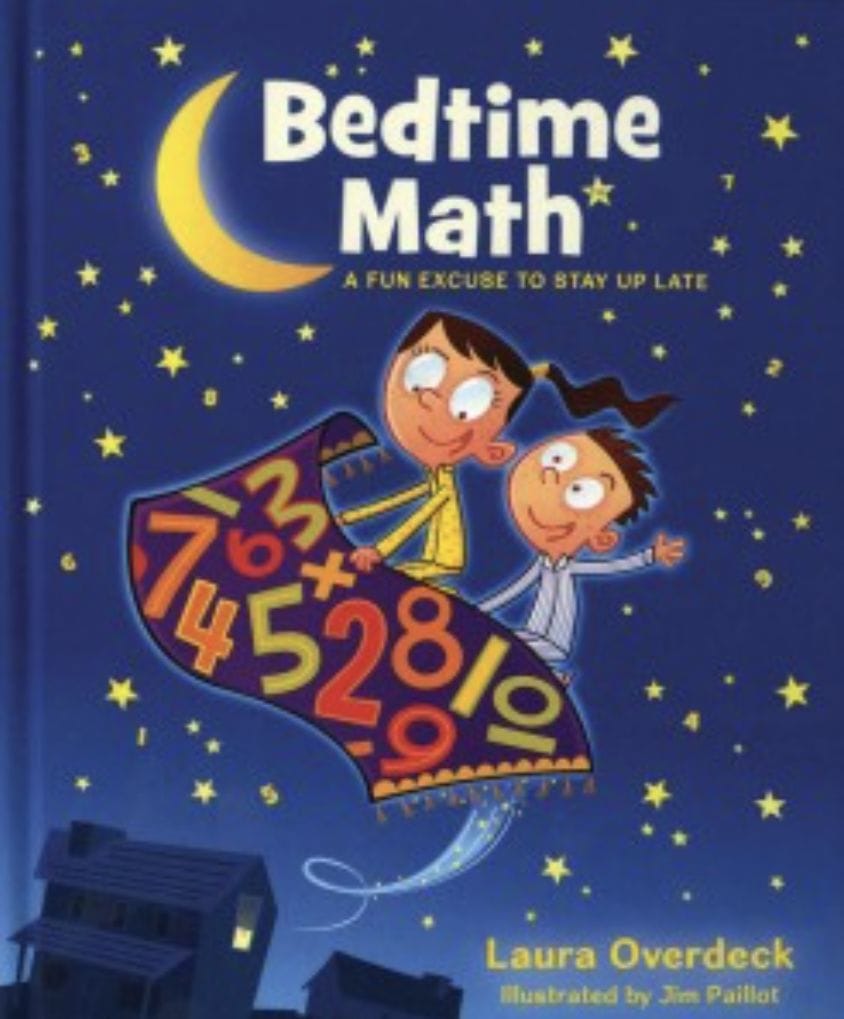

BEDTIME MATH

It’s more than a book, a daily emailed math problem or an app.

“We are really trying to start a movement,” says Bedtime Math founder, Laura Overdeck, WG’95.

The aim is to get children to love math at an early age—“before they get turned off by it,” Overdeck says.

At first, they started out to merely get their own kids to love it—they being Overdeck and her husband John. For several years they had been giving math problems to their two children at night, in much the same way that many parents offer bedtime reading. The bulb popped when their third child—a 2-year-old son— demanded math problems like those his big brother and sister received. Eventually, family friends heard about the Overdeck nightly ritual and asked for their own math puzzles too.

By February 2012, Bedtime Math had set up 10 families in NYC and Short Hills, N.J., on a pilot program. The families provided feedback—i.e., their kids bugged the parents for more questions—and Overdeck expanded the pilot to twice as many families. By summer, she was partnering with one out of six libraries in New Jersey, providing them with 8,000 “summer of numbers” calendars. That figure grew to 75,000 calendars in 2013. More than 600 libraries have ordered their pajama party products—kits of math-related activities like anagrams and zip-line kits for stuffed animals for parties.

“There’s an appetite for this stuff,” Overdeck says, and much like any lean startup, Bedtime Math uncovered that appetite by quickly distributing products and services and pressing forward with those that were well received in the market—i.e., got parents, kids and libraries excited.

In 2013, those consumers got excited, and for those who know how to calculate probabilities, 2014 looks to add up to yet more success. A Bedtime Math book was released in June 2013 and ultimately rose to the number 11 best-seller spot on Amazon. Another book will be released in March 2014. The connection with libraries has grown to the point where Bedtime Math is partnering with the American Library Association (ALA); its calendars are available in the ALA’s summer reading catalog for 16,000 libraries to order. And through schools, Bedtime Math is hoping to launch the “Crazy Eights” nationwide math club in spring 2014.

The success is as much about winning over the kids as it is the adults. Most parents have flashbacks to their school arithmetic, and they often inadvertently pass the fear and loathing on to their children. For Overdeck (an astrophysics major in college) and John (a mathematician), who both grew up in math-friendly households with moms who loved the subject, that wasn’t an issue.

What perhaps could have been an issue with the nonprofit is familiar to all startups: manpower. Overdeck staffs Bedtime Math with five other people, and the startup requires an all-hands-on-deck approach where employees wear multiple hats.

“We hand cut things,” Overdeck adds, to give us a sense for just how many jobs they share. “We are very much a startup even though we are a nonprofit.”

DAGNE DOVER

“Dagne” is the Nordic word for new dawn. “Dover” is the surname of co-founder and creative director Jessy Dover. Loosely translated, Dagne Dover stands for a handbag revolution.

It began, as many Whartonite startups do, in the pressure-cooker incubator that is campus. As co-founder and CEO Melissa Shin Mash, WG’12, recalls, the spark ignited for her when she watched her classmates doing, as Mash puts it, the “two-handbag schlep” during DIP—the Dedicated Interview Period for Wharton MBA students. One handbag for their usual, everyday stuff. The other handbag to get them a job. Or worse, students attempted to fit everything into one disastrous “blackhole bag.”

Dagne Dover bags combine style and practicality.

Mash once worked at Coach, and she could see that her fellow young professionals were a target, but unsatisfied, audience. What would satisfy them? Style and practicality.

She connected with Deepa Gandhi, WG’13, now COO/CFO, and Dover, who had won a Coach accessories design competition. The three worked on the startup as an independent study project, guided by David Bell, Wharton’s Xinmei Zhang and Yongge Dai Professor. On campus, they tested their core demographic and surveyed more than 1,000 women and men. And they honed in on the direct-to-consumer, online business model because it’s worked for today’s insurgent e-retailers—yet hadn’t been done yet for handbags.

“This is an extremely effective way to build a brand today,” Mash says, explaining that direct-to-consumer allows a firm to control the entire customer experience.

Their project garnered them quick recognition—they scored a 2012 Wharton Venture Award—and they have worked to build on that success full time for the past couple years. Dagne Dover is currently raising its first small investment round from angel investors, and friends and families, including support from Dorm Room Fund, which is backed by Philly-based and Whartonconnected First Round Capital. In early 2013, Dagne Dover went forward with a soft launch; a pre-sale began in March 2013 demonstrated they had more demand than they could keep up with, Mash says. Building their NYC manufacturing operations to meet market demand has been a major challenge since the start. This holiday season, they sold out of holiday inventory within 2.5 weeks of it going live. They are scaling their operations abroad to keep up with current demand and their growth trajectory.

“Additional funding would help hold adequate inventory levels, turn on PR and make some key hires,” Mash adds. “It’s literally just three of us running around our NYC office. We can’t wait to get a few more hands on board!”

FUNDERSCLUB

With the U.S. Securities and Exchange Commission (SEC) expected to soon issue new rules on crowdfunding for companies, the fear is that “dumb money” will pour in to fund startups.

FundersClub has never attracted dumb money—though it is not exactly a crowdfunding platform. It’s the “world’s first online VC firm,” according to co-founder Alex Mittal, ENG’07, W’07.

Since its start nearly two years ago, FundersClub has been performing rather smartly. Its membership base of more than 7,600 includes executives, founders, directors and managers. It has deployed $10.7 million for its 55 portfolio companies, 80 percent of which are revenue generating.

Success tends to follow its founders, Mittal and Boris Silver, W’10. Mittal was fresh off the success of Innova Dynamics, the nano-materials firm for which he still serves as board director. Silver built some of Facebook’s first fantasy sports games. Citizen Sports bought them, then Yahoo bought it, leading him to become a West Coast angel investor. Both first met on Penn’s campus outside a Hemo’s food truck; they reunited in the Bay Area and joined forces with the same realization: the startup fundraising and investing process was inefficient.

“If you talk to founders and ask them how enjoyable fundraising is, they will look at you like you’re crazy,” Mittal the founder says.

Silver’s perspective, on the other hand, is as an investor who was having trouble finding companies to fund.

They launched FundersClub to solve the issue for themselves, startups and accredited investors.

“The reality is, no one had really tried to solve the problem of why is it that there are all these people who invest in real estate and public stocks, but they just don’t invest in private companies,” Mittal says.

FundersClub is a platform that allows its members to get in on the ground floor with dozens of startups. The twist is that FundersClub removes some of the dice rolling of early-stage investing. The group’s investment committee pre-selects opportunities. Members can buy stakes at what are essentially rock-bottom amounts: as little as $2,500 to $5,000 a company. That amount, nevertheless, can add up for a startup.

“We’re aggregating all these little checks together … and we’re writing [the startups] a big institutional check,” Mittal says.

The platform removes the historical exclusivity of startup investing, but one of its recent changes is to raise the bar to join the “club.” Originally, prospective members filled out an application to prove they possessed a minimum income and net wealth to be accredited investors (those levels are set by the SEC at liquid net worth greater than $1 million or annual income of $200,000). As of the past summer, one must be invited to participate from a current member, or in the very least request an invitation.

The reason for the rule change, Mittal explains, was mainly to protect one of the fund’s best assets, its community. Not only do portfolio companies get money, they get a network of club members who can open doors and provide guidance. Investors get to tap into this collective brainpower and connections too.

One company they funded that has continued to flourish was in Indianapolis; no one in the Valley knew about it. FundersClub did because one of its members resides in that area. That’s pretty smart money.

GRAPHENE FRONTIERS

Perhaps it is a stretch to say that Graphene Frontiers will help produce some of the freakiest products of the 21st century. Media outlets with far bigger budgets than ours, after all, have trumpeted graphene as a “miracle material.” And the startup born and currently living in the Science Center is poised to solve the one quandary holding graphene back from realizing its full potential: it is hard to produce in large quantities. Graphene Frontiers knows how to mass produce the stuff.

At its essence, graphene does not sound too exotic. It is a form of carbon— but a form of carbon that happens to be only one single atom thick. The professor who discovered it did not earn the 2010 Nobel Prize in Physics for nothing. Graphene is incredibly strong, transparent, impermeable and conductive. It is the most conducive material for heat and electricity.

“Period. Bar none,” says CEO Michael Patterson, WG’12.

A.T. Charlie Johnson, director of Penn’s Nano/Bio Interface Center and a professor in the Department of Physics and Astronomy in the School of Arts and Sciences, along with Zhengtang Luo, a former postdoctoral researcher in Johnson’s lab, developed the technology behind the firm. They then launched Graphene Frontiers in 2011 through the special resources of Penn’s Center for Technology Transfer’s UPstart program, which both serves as a Penn business incubator and connects researchers with entrepreneurs—in this case Patterson, who was then still in the MBA for Executives Program.

Patterson quips that at his last job his office overlooked the 10th hole of a golf course.

“Now I sit next to a 1,000-degree graphene furnace.”

That chemical vapor deposition (CVD) furnace is used to “cook” graphene onto another metallic substrate. The graphene can then be peeled off this other metal—a sustainable and reliable way to generate it.

The 1,000-degree chemical vapor deposition graphene furnace.

In September 2013, Graphene Frontiers took a big step forward by earning a $745,000 National Science Foundation grant, which came after a first round of funding of $500,000, mostly gathered from angel investors and Patterson’s WEMBA 36 East classmates. Whereas the first round of money allowed Graphene Frontiers to grow to five employees over 18 months, the NSF funding will help the company take their graphene production to an industrial scale—with a CVD furnace the size of a printing press.

The firm is also perfecting ways to lay the carbon atoms onto a silicon wafer, which is then carved into semiconductor chips for use in chemical and biomolecule detection.

All of the potential everyday uses for graphene-enabled technologies sound awesome to a layperson, but for Graphene Frontiers, the awe comes in the size of some of these markets. Graphene could enable the creation of “bendy” electronics, which represent an $8.2 billion market; desalination filters, a $2.7 billion market; and point-of-care (POC) diagnostic instruments, a market that could range in the multibillions, estimates Patterson.

Of course, a lot of work stands between Graphene Frontiers and those markets. For electronics, for instance, Patterson says the firm must demonstrate that its graphene works in the promised way and that mass production is possible at an economical price. For POC diagnostics, the plan is to first get the graphene-powered sensors in the hands of researchers, then work with a partner to get them in the hands of health care practitioners. These uses might not be commercially available for a few years, but to help get them there, Patterson eyes a second funding round of $1.2 million and many more days beside the furnace.

NEXERCISE

Humans cannot live on bread alone, and they cannot be motivated simply by knowing that eating too much bread (or eating fatty, salty, sugary foods, or occupying the couch for hours on end) is bad for them. It is sad but true that most human beings need to be rewarded to change behaviors. Scientific research, frighteningly enough, has shown that as many as 78 percent of us do not have the internal motivation to stick with a long-term exercise program.

Benjamin Young and Gregory Coleman, both WG’09, experienced that 78 percenter effect when they were enrolled in the Wharton MBA for Executives Program. They commuted every other week from Washington, D.C., had young children and worked full-time jobs.

“Taking care of yourself became less and less a priority,” Coleman recalls.

Fit people before, the two men realized they needed to “get off their butts” and get back to exercising. Motivation would help. They sought to provide it. Initially, they envisioned Nexercise as a service that would help people find exercise opportunities wherever they might be on their personal or business travels. Young (now CEO) and Coleman (now COO), along with classmate Boomie Odumade, WG’09 (now vice president of engineering) “baked” the idea through the three entrepreneurship-focused classes at the end of their second Wharton year.

“When we got to the end, it wasn’t quite ready for prime time, but we were sure something was there,” says Coleman.

Three things helped them turn the corner—the emerging ubiquity of smartphones, the addictive nature of mobile social gaming and the book Influencer, which provided them a blueprint for their startup platform.

What resulted is the Nexercise app that provides “moment-based rewards”—like free product samples, retailer discounts, downloads and other promotional products—when users score points by completing an exercise activity, reaching milestones, and competing with friends and colleagues. Users get the motivational “fix” they need to keep scoring points (and get in shape), while Nexercise partners with big-name brands and their mobile ad agencies that specialize in moment-based marketing.

Nexercise got into shape through the elite TechStars accelerator program, which they completed this past August, and it has already reached a point of profitability. (It was originally funded through angels, Coleman says, and the firm recently closed a $1 million seed round.)

Part of its profitability can be attributed to the success of the app. It has been downloaded more than 1 million times, and users have logged 7 million individual exercise sessions totaling 300 million minutes. Savvy media relations can also be a reason, with many regional and national mentions. Another reason is that the app appears to work. Traditionally, says Coleman, the critical juncture for exercise and health regimes is the six-week mark, after which users quickly give up. The Nexercise product is designed to overcome this obstacle.

And if we can dabble in a little philosophy, good things tend to come to people doing good. Ultimately, the Nexercise team hopes to develop an agnostic platform that will integrate with other health-based mobile tools. But in the meantime:

“The thing that really motivates us is the testimonials we get back from our users,” Coleman says.

One of their earliest die-hard users was a diabetic. After a few months of Nexercise, blood results showed an improvement never seen before by her doctor.

VERBALIZEIT

You probably at this point have heard their story and learned how to pronounce their name (“verb-a-lize-it” with the stress on the first syllable). About how they stared down the “shark” investors on ABC’s popular TV program, Shark Tank. About how they first came up with an idea for an app that provides users with a live translator when traveling abroad. (The traveling issue for co-founder Ryan Frankel, WG’12, was particularly eyeopening as he was ill in a foreign land and unable to communicate his distress with a doctor.) You may have even read some of this through Wharton Magazine (as we should clear the air and disclose that Frankel is one of our alumni bloggers).

What you might not know is how well Frankel (now CEO); co-founder Kunal Sarda, WG’12 (now COO); and VerbalizeIt are faring. Their app experienced 20,000 downloads right after the show, and they tentatively agreed to partner with one of the sharks. But in real-world time, the TV show is old news; the segment was filmed more than 18 months ago. So what is most noteworthy about this startup is the broadening of its business plan since then.

The founders aim to make VerbalizeIt synonymous with “all things translation,” Frankel says—like the “the little engine that could, the engine behind all things translation.”

VerbalizeIt is now less about an app than it is a full-service translation platform. It is not as much about attracting casual users trying to order in a French restaurant or hoping to communicate with a hostel operator in Thailand, as it is about serving a business community that has come to rely, typically, on antiquated, expensive and analog translation services that cannot keep up with its multilingual, multinational communication demands. They still have the app, but VerbalizeIt’s team aims to disrupt the old agency and call center model of translation services with a distributive workforce model.

By Kunal’s estimate, VerbalizeIt currently partners with 15,000 translation contractors around the world who speak 11 languages, up from 3,000 translators and five languages just 18 months ago.

Providing translation services to businesses is such a huge opportunity— and language barriers so pervasive—that they have had to temper their enthusiasm to dive in too fast, for risk of spreading themselves too thin. They became more selective, targeting industry verticals and particular companies. Kunal and Frankel have also forged strategic partnerships with Skype, American Airlines, Rosetta Stone and the world’s largest travel management company.

And then there was the partnership with the investor from Shark Tank. Turns out, VerbalizeIt eventually turned down that offer. They instead raised $1.5 million in an initial funding round that closed in October 2012. They have some of that cash left in the bank, they say, and are also reinvesting in the company using revenue from customers. Translated into any language, that spells success.

Financial Founders A’Plenty Too |

| Wharton’s long-standing prowess in finance and its hot entrepreneurial ecosystem intersect. Numerous alumni have founded private equity, hedge fund, venture capital, investment management and other financial firms, leading the way for today’s students to explore the path of financial innovation.

“Wharton’s long history of successful, entrepreneurial alumni act as role models for current students, exposing them to potential career paths in the financial industry. The Wharton finance curriculum encourages individual solutions to complex challenges. It is no surprise that several years of creative problem-solving would lead Wharton alumni to determine that they can start their own firms in the financial services industry,” says James Dinan, W’81. That list of alums includes (though is not limited to): Dinan as founder of York Capital Management; Rob Coneybeer, WG’96, of Shasta Ventures; Michael Delaney, WG’82, of Court Square Partners; Craig Effron, W’81, of Scoggin Capital Management; Josh Harris, W’86, with Apollo Management; Daniel Och, W’82, of Och-Ziff Capital Management Group; Marc Rowan, W’84, WG’85, also at Apollo Management; Fred Wilson, WG’87, with Union Square Ventures; and Emil Woods, W’94, of Cedar Hill Capital Partners.Other founders and alternative investment pros connect through the Wharton Private Equity & Venture Capital Alumni Association.Students tap into numerous resources, including the many mentioned in the Winter 2014 cover article (“A Bounty of Business Plans“), as well as the Wharton Private Equity & Venture Capital Club, one of the largest student-run clubs with more than 700 members. “Wharton is a magnet for students interested in capital markets. They are smart, creative, very motivated and have intimate knowledge of financial markets. The various courses and co-curricular programs offered by Wharton Entrepreneurship provide our students with solid foundations for launching and growing their companies,” says Raffi Amit, the Robert B. Goergen Professor of Entrepreneurship and academic director of the Goergen Entrepreneurial Management Program. “I am proud of the many promising ventures that were formed by our undergraduate and MBA students.” —Matthew Brodsky |