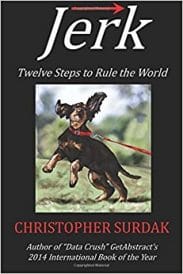

Jerk: Twelve Ste ps to Rule the World

ps to Rule the World

Christopher Surdak GEX96

Ouray Mills Omnimedia

Surdak believes the endless parade of startup companies like Uber, Lyft, Airbnb, and their ilk are like so many young dogs pulling defiantly on the leash of the collective business world. In Jerk, he explores how these companies successfully rode the Big Data wave and flourished while more-established companies found themselves washed away by the flood. These startups aren’t nurtured and raised, he says—they explode on the business scene with lofty business plans, disrupting all activity around them. These “jerks,” however, seem to serve an important service. By examining the behaviors and motivations that fueled “jerkdom,” from the advent of world history to the most recent tech startup, Surdak isolates the actions and behaviors that have helped these Davids consistently slay their Goliaths.

Quantitative Momentum: A Guide to Momentum-Based Stock Selection

Wesley R. Gray W02, PhD and Jack R. Vogel, PhD

Wiley Finance

The authors bring the world of momentum investing from Wall Street back rooms and into the hands of individual investors with this text, providing guidance to help you hone your own momentum investment strategies from the bottom up. Learn what momentum investing is—buying winners, essentially—and what it isn’t. Discover how momentum can help you beat the market. Access the tools that ease DIY implementation of these strategies. In the end, you’ll learn tips and strategies for any momentum-based investment plan.

The Debt Trap: How Leverage Impacts Private-Equity Performance

Sebastien Canderle WG99

Harriman House

Call it “the art of the leveraged buyout.” In The Debt Trap, Canderle explores some of the more controversial business strategies such as quick flips, repeat dividend recaps, heavy cost cutting, and asset stripping as related to leveraged buyouts. By matching each chapter with a related in-depth case study from companies such as Caesar’s, Debenhams, EMI, Hertz, Seat Pagine Gialle and TXU, the author brings these investment strategies to life through real-world application—offering an up-close view of private equity deal-making. The text is a great resource for PE fund managers and businesspeople alike.

At My Pace: Lessons From Our Mothers

Jill Ebstein WG83

SizedRight Marketing LLC

Ebstein’s book was motivated by the author’s own stories of her mother’s resilience and the lessons she drew from them—including the tale of how, at age 81, her widowed mother set off to complete college. 37 additional stories collected here span across ages and perspectives, such as one daughter’s reflections on how she learned to embrace strength through her mother’s low self-esteem. Though the lessons learned vary as much as the stories, all of the narratives show complexity, and provide ample opportunity for self-reflection.

Disciplined Growth Strategies: Insights from the Growth Trajectories of Successful and Unsuccessful Companies

Peter S. Cohan WG85

Apress

The central lesson of the Forbes columnist’s 12th business book is that companies can grow only by adjusting to current trends, not by sticking to tested models. The author expands on five dimensions of company growth (a subject he’s written about for Knowledge@Wharton): customers, products, capabilities, geography and culture. Cohan’s novel treatment of culture is the most resonant part of the book, and unlike other strategy texts on the market, it aims to provide a guide to creating a culture that is geared towards growth.