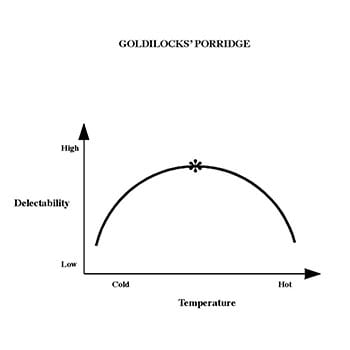

When most people think about performance—individual or collective—their tendency is to envision yardsticks or other linear indicators. But there’s an enormous swath of problems whose optimal solution is curvilinear or parabolic—and best described by an inverted U-curve. The y-axis usually is performance, and the x-axis a variable that ranges from low to high.Goldilocks is Exhibit A. In her case, the preferred temperature of the porridge is at the top of an upside-down curve—not too cold, not too hot.

Perhaps the next most famous inverted U-curve—and one of the first actually sketched—is the Laffer curve. Economist Arthur Laffer drew a parabola to express his notion that maximum government revenues result from a tax rate that is neither too low nor too high.

In organizations, goal-setting for an individual or a group tends to be curvilinear. The trick is to avoid the extremes: so easy that the task is not challenging enough, nor so difficult that frustration sets in.

Innovation, to make a difference, must be neither so mundane that it fails to capture people’s imagination, nor so radical that they cannot relate to it. In other words, successful innovation straddles novelty and familiarity. In a similar vein, TED talks last 18 minutes—long enough to have substance yet short enough to keep the audience engaged.

A longstanding issue in the strategic management literature is the relative importance of shareholders vis-à-vis stakeholders. Stakeholders are any interests or systems that affect and/or are affected by an organization. Stakeholders typically include employees, customers, suppliers, communities, the environment and posterity—as well as shareholders. The most intelligent response to the issue appears to be curvilinear. Too narrow a focus on shareholders’ returns or too diffuse an attention to multiple constituencies will likely reduce corporate performance.

A cardinal principle in negotiations is always to leave some money on the table. The analog with business behavior is to never squeeze the last dollar out of a customer or client. According to retail legend Sol Price, founder of Price Club (which later merged with Costco), “If you recognize you’re really a fiduciary for the customer, you shouldn’t make too much money.” And in all likelihood you will encounter that adversary or transaction partner in the future—for worse or for better. In the words of L.L. Bean founder Leon Leonwood Bean, “Sell goods at a reasonable profit, treat your customers like human beings and they’ll always come back for more.”

There is ample evidence—reported in Harvard Business Review and Fortune—that superior CEO performance reflects tenure neither too short nor too long. What’s more, MIT professor Alex Pentland in his book Social Physics, reports that the best-performing financial traders avoid the extremes of isolation from others and overinvolvement with others. Finally, some advice that I was given when entering management consulting several decades ago: Dress a level above the client, but not more than that.

Goldilocks-thinking is all about finding a sweet spot. Precision is not important. University of California, Berkeley planner and architect Christopher Alexander has introduced a wonderful locution: “nature’s relaxed geometry.” That is exactly the perspective to take when making sense of a curvilinear relationship. After all, Goldilocks didn’t need a thermometer.