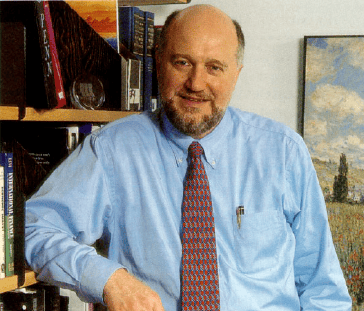

Last year, Richard Herring, vice dean and director of Wharton’s undergraduate division, published a book called Financial Regulation in the Global Economy, an analysis of policies for regulating international financial institutions. His co-author was Robert E. Litan, a Wharton undergraduate from 1972.

This year, Herring, who has been a finance professor at Wharton for 26 years, and a colleague are conducting a study that measures the value of liquid secondary markets. To verify some early conclusions about his analysis, Herring conferred with Allen Levinson, W’77, a former student who is now at Goldman Sachs.

Herring, currently beginning his second year as undergrad vice dean and director, clearly knows first-hand the capabilities of Wharton undergraduate alumni. Yet given his impressive list of scholarly and professional credentials — from consulting with government agencies like the Federal Reserve Board, the Council of Economic Advisers and the U.S. Treasury to serving as founding director of the Wharton Financial Institutions Center — one wonders why Herring would agree to take on a demanding administrative job in a busy suite of offices far removed from Wharton’s finance department.

Herring has two answers: As winner of the Hauck Award for distinguished undergraduate teaching, he believes he can contribute to the ongoing debate over undergraduate curricular issues; and under Wharton Dean Thomas P. Gerrity, he feels there is a willingness to pay attention to, and rethink, undergraduate education.

There are other reasons why this top administrative job might be appealing to an academic. Wharton is widely believed to have the best undergraduate business school in the world — a reputation confirmed by outside polls and reflected in the 20 percent increase in applications for the current year (vs. a five percent increase for Penn overall). In the last year alone, Wharton’s undergraduate programs, students and alumni have appeared in publications ranging from the Wall Street Journal and New York Times to U.S. News & World Report and the South China Morning Post.

In addition, the School has led the way in expanding the boundaries of undergraduate business education to include more emphasis on leadership skills, including the ability to negotiate and communicate with peers, to work with teams, and to understand the economic, political and social environments in which global business is conducted.

Not that the job of vice dean and director doesn’t have its challenges. Between 1988 and 1994, the number of entering freshmen in U.S. colleges and universities planning to major in business fell by 42 percent — a trend that has made it all the more imperative for Wharton to get its message out to prospective applicants.

“Recruiting high school students is a two-step process,” says Herring. “First, we need to educate them about what a business school really is. Too many students, especially at the top end, think of it as a narrow, constricted trade school when in fact what we do here is help them transform personal interests and academic passions into career opportunities. Students are offered an intellectually challenging and rigorous program that teaches them above all how to structure problems and make decisions.

“Second we need to emphasize that our particular curriculum is fully integrated with the College of Arts and Sciences from the first day students set foot in the university. We believe very strongly that we are training people who have to function well in a global economy. We require these students to be proficient in a foreign language and we offer them programs for study abroad. Students leave Wharton with the advantages of a liberal arts education, plus the functional and analytical skills that will enable them to compete effectively in the business world.”

When one takes into account two very popular joint degree programs — the Jerome Fisher Program in Management & Technology (M&T) and the Program in International Studies & Business (IS&B) — “we are clearly attracting some of the most talented undergrads in the world,” Herring notes. Undergraduate SAT scores underline his point. The average for students in the School of Arts and Sciences is 1353 (out of a total 1600). For engineering students, it’s 1371 and for Wharton students it is 1401. Average scores for IS&B students is 1472 and for M&T students, 1495.

In the M&T program, which is limited to 50 students, graduates earn a BS in Economics from Wharton and either a Bachelor of Science in Engineering (BSE) or a Bachelor of Applied Science (BAS) from Penn’s School of Engineering and Applied Science. The goal of the program since its establishment in 1977 has been to educate young leaders who can bridge the disciplines of both management and technology.

“The M&T program is so renowned that we are drawing first-rate students who otherwise would be looking at MIT, Harvard and Stanford,” says Herring.

It’s a similar story with IS&B, which takes 40 students and integrates a business education, advanced language training and a liberal arts education with an area study specialization. “What we offer these students is a liberal arts program together with business competencies. It’s also an effective way for us to emphasize the international dimension of our curriculum.” Students graduate with a BA in International Studies from the College of Arts and Sciences and a Bachelor of Science in Economics from Wharton.

The newest joint degree program is with Penn’s School of Nursing. Faculty approval of this initiative last spring means that Wharton now has undergraduate joint degree programs with each of Penn’s undergraduate schools.

Two years ago, Wharton faculty approved a concentration in environmental policy and management, which draws between 10 and 15 students a year.

“Another curricular innovation that adds opportunities for our students is the concept of university minors, which allow students to focus on a subject area that spans different schools,” notes Herring. “As yet the only approved minor is math (through the college) and actuarial science (through Wharton’s insurance department). Others, however, are in the works and we expect to approve them this coming year.”

Educational initiatives aside, Wharton’s undergraduates are clearly exceptional on their own merits. First, there is the high number of students — more than 20 percent — who graduate with two degrees, such as a BA from the College of Arts and Sciences and a BSE from Wharton. “It’s another indication how energetic and ambitious these students are, because in order to graduate with degrees in, for example, German and finance, you have to take a substantial number of credits above the minimum,” Herring notes. “Second, Wharton students are in a disproportionately large number of leadership roles at Penn, which isn’t surprising. We choose our applicants because we think they have leadership potential, and they don’t disappoint us.” Wharton students last year, for example, were president of the undergraduate assembly, chair of the Student Committee on Undergraduate Education and president of the Pan Hellenic council. They tend to be leaders of their fraternities and sororities and many have played on Penn’s sports teams. Wharton undergraduates were active in 35 Wharton clubs ranging from the Awareness of International Markets club, Two Shades of Green environmental club and Finance club to the Pennsylvania Investment Alliance, the Sports Executives club and the Accounting club.

In addition to holding a leadership position at the University, today’s Wharton student is more apt to study abroad than students even five years ago. “Living-learning” programs are already established in Lyon, France and Madrid, Spain, and an exchange program has existed with Bocconi, Italy since 1993. Last spring, the faculty approved two more exchange programs, one with Hitotsubashi University in Tokyo and one with the Hong Kong University of Science & Technology, “which, although founded only six years ago, is already one of the top-ranked institutions in the Far East,” says Herring. “This program will be particularly interesting to our M&T students because it has both an engineering school and a business school.”

The difficulty in establishing programs abroad, he adds, “is making the calendars fit. Almost no place in Europe has a fall semester that looks anything like ours. And the spring semester is tough because students frequently want to stay on campus to look for a summer job. Given those constraints, we have been fortunate in setting up the programs we have.”

Herring readily gives much of the credit for the undergraduate program’s successes to two individuals: his predecessor, Janice Bellace, now deputy dean of Wharton, who made study abroad programs a priority during her tenure as undergraduate head; and Gerrity, whose “intimate knowledge of the division and commitment to excellence in undergraduate education provide a strong impetus for innovative programs.

“To work with a dean who cares deeply about the undergraduate program at a time when the University of Pennsylvania itself is redirecting resources towards undergraduates made this job an inviting opportunity,” says Herring.

PART TWO: RESEARCH AGENDA

Financial Regulation in a World Economy

In 1992, when Herring was researching his application for the $3.4 million Sloan Foundation grant that would fund the Wharton Financial Institutions Center, one of the challenges he faced was convincing the Foundation of the importance of financial services to the U.S. economy. Herring’s findings surprised even himself.

“It turns out that more than twice as many people are employed in the financial sector than in the apparel, automobile, computer, pharmaceuticals and steel industries put together,” says Herring, referring to those industries that already had research centers funded by Sloan at other universities. “It made an obvious case in terms of the centrality of financial services to the economy.”

Not just to the U.S. economy but to the international marketplace. “Finance more than any other industry is global,” Herring notes. “There are markets that literally never close. And the impact of technology on financial services has been tremendous. You don’t have to be a wild-eyed futurist to understand that we are training people who, armed with a laptop PC and a modem, can go virtually anywhere in the world and do any kind of financial transaction. That was unthinkable 15 years ago.”

Such changes, Herring says, “mean that it’s very difficult for a country to wall off its financial markets from the rest of the world even if it wants to. That, in turn, means there is a hugely reduced scope for governments to regulate their own financial industry more harshly because it is so easy these days to reconstruct a financial transaction in a much more hospitable jurisdiction at much lower cost.”

We’ve seen examples of this over the past decade, Herring says. “When the Germans started to put a tax on trading bonds, all the bond trading activity moved to London. Swedes put a tax on financial transactions, which meant all the Swedish shares began to be traded in London. That has created a degree of international integration that is quite unusual across all sectors.”

Which gets to the subject of his book, Financial Regulation in the Global Economy. The consequences of financial markets becoming more and more accessible to cross-border transactions “is both a challenge and an opportunity,” Herring says. “You have to start thinking about cooperating and coordinating internationally, but the question is how? What are the rules of engagement? We take a minimalist view in the book, that basically you want to give the markets as much scope as you can so they can work more efficiently. Regulation and supervision should play more of a circuit-breaker or backstop role, to protect society against upheavals like disruption of the payment system or a colossal default.

“Our book goes through all the rationales for regulations and asks how they change in a global economy. We start with some interesting work done on international cooperation in the public health sphere because that is one place where it really works. You have the tendency to assume that of course people would want to cooperate in combating typhus and other diseases. Yet it took about 150 years to make any progress. The key issue is how you achieve international agreement on a course of action. The same questions relate to the financial services sector. People have strongly held views of the weaknesses and the problems, but more than that you need to have a particularly strong consensus on what the solutions are.”

There has been significant progress in “harmonizing banking regulation internationally, much less progress in securities market regulation and almost no progress in insurance regulation,” Herring says.

One of his current research projects offers an example of the problems posed by financial regulations. He and another professor are attempting to discern the value of liquidity, i.e. the value of the option to be able to trade something in a perfectly liquid secondary market.

Specifically Herring is looking at the perpetual floating rate notes market that was active in London in the mid-1980s. “It was a hugely successful innovation that turned out to be a cost effective way for banks to raise capital by issuing what was essentially a floating rate debt instrument that never matured. It was traded in a market that seemed to be so broad, deep and resilient that people didn’t worry about the fact that it had no maturities. It would be reset to par and you were protected against interest rate risk because it would be set every three to six months. As a result, you had huge amounts being transacted at very small spreads.

“Because the Japanese were placing huge amounts in international interbank markets, many of these ended up in their hands. It all went very smoothly until the U.S. Federal Reserve Bank and the Bank of England started talking about setting international standards for capital adequacy. The Bank of England firmly believed that it was very dangerous for banks to hold capital claims on other banks. So they insisted these be deducted from capital. The idea was to avoid a situation where you have one bank bringing another one down, and so on, leading to a major collapse.

“In any case, rumor of this pending regulation got around to the Japanese who believed they were ultimately going to have to buy into this kind of system. Here they were sitting on all these capital claims on other banks that were going to be a liability for them in figuring out capital costs. When they all tried to sell their positions, the whole market collapsed.

“So you had this transition between an almost perfectly liquid market and a virtually illiquid market, and it gave you an unusual opportunity to measure the value of a liquid secondary market, which we estimate at 15 to 20 percent. That’s how much the value of the security suddenly fell …

“There are only two free lunches in finance,” says Herring. “One is diversification. If you diversify a portfolio you can get the same return for less risk. With liquidity, if you can develop a liquid secondary market, you can actually enhance the value of the security.”

Herring received his AB from Oberlin College and his MA and PhD from Princeton University, where he taught before coming to Wharton.

He is a founding member of Wharton’s International Forum — an executive education program that brings together 30 CEOs from around the world to examine global strategic issues. The group meets three times a year in Philadelphia, Bruges, Belgium and Kyoto, Japan. For the meeting this fall in Philadelphia, Herring organized sessions on the medium-term outlook for the world economy, evolving North American trade policy and managing financial volatility.

This summer Herring taught an executive education course in Singapore in July and in August presented a paper at a Wharton Japan conference in Tokyo on the Japanese banking crisis.

In addition to his research on international finance, Herring has advised multilateral lending agencies such as the International Monetary Fund and the World Bank. He is cochair of the Biennial Multinational Banking Seminar, a member of the Group of Thirty Committee on Supervision and Regulation and the international specialist on the Shadow Financial Regulatory Committee, a group of 12 academics, lawyers and former government officials who meet four times a year in Washington, D.C. to propose changes in financial regulation.

Herring’s role on the committee is to cover international issues that affect regulation, “everything from the debt crisis to minute details on applications procedures for foreign banks.” The group’s recommendations frequently are covered by the business press and occasionally have a direct impact on legislation. For example, the shadow committee’s proposal on prompt corrective action was incorporated into the Federal Depository Insurance Corporation Improvement Act in 1991 which induces owners of a bank whose capital position is declining to either recapitalize, merge or close down. “The idea is that you want market forces to discipline banks so that they don’t become problems.”

The members of the committee “all have drastically different opinions, which is what makes it so much fun,” says Herring. “It’s a wonderful way to learn from colleagues and it’s also as close as you can get to merging theory with application.”