The physical transfer of large amounts of currency across national borders is an anachronism; drug smugglers provide one of the last surviving examples. Virtually all of the trillions of dollars, marks and yen that make their way around the world each day are electronic — chains of zeros and ones. Only at the very end of its journey is money transformed into something tangible: credit cards, checks, cash or coins.

The physical transfer of large amounts of currency across national borders is an anachronism; drug smugglers provide one of the last surviving examples. Virtually all of the trillions of dollars, marks and yen that make their way around the world each day are electronic — chains of zeros and ones. Only at the very end of its journey is money transformed into something tangible: credit cards, checks, cash or coins.

Although many new forms of “electronic money” are under development, it is useful to look at three general categories: electronic debit and credit systems; various forms of smart cards; and true digital money, which has many of the properties of cash.

Electronic debit and credit systems already exist. When a consumer uses an ATM card to pay for merchandise, funds are transferred from his or her account to the merchant’s. Computer software such as Intuit provides electronic bill payment, and it is but a short step to true electronic checks — authenticated by a digital signature — that can be transmitted to the payee, endorsed and deposited over the Internet. Electronic debit and credit systems represent new, more convenient means of payment, but not new payment systems.

Smart cards and digital money do represent new payment systems with potentially revolutionary implications. Smart cards are plastic “credit” cards with an embedded microchip. Many are now used as telephone or transit payment devices. Mondex, a smart card or electronic purse currently being tested, can be “loaded” with money from an automatic teller machine (ATM) or by telephone or personal computer. Money is spent either by swiping the card through a retailer’s terminal or over the Internet by using a card reader and a personal computer. At this most basic level, a smart card is simply a debit card that does not require bank approval for each transaction. There is no reason, however, that smart cards have to be so limited.

Banks or other institutions could provide value on smart cards through loans, payments for services or products. The immediate transfer of funds between bank accounts is not necessary; value can circulate from user to user without debiting or crediting third-party accounts. The Mondex card, for example, allows anonymous peer-to-peer transfers though an electronic wallet. Assuming confidence in the creating institution, “money” could be created on smart cards and circulate almost indefinitely before redemption.

Finally, electronic money can take true digital form, existing as units of value in the form of bytes stored in the memory of personal computers that may or may not be backed by reserve accounts of real money. The money could be downloaded from an account, supplied as a loan or as payment, or bought with a credit card over the Internet. As long as digital cash can be authenticated and there is confidence in its continued acceptance, it could circulate indefinitely, allowing peer-to-peer payments at will. These are big “ifs,” but they are well within the realm of the possible.

Imagine a world where true e-cash is an everyday reality. The year is 2005. You have a number of brands of e-cash on your computer’s hard drive: some withdrawn from a bank in Antigua, some borrowed from Microsoft, and some earned as payment for your services. You can use the digital value units (DVUs) to purchase information from a web site, pay bills, or send money to your daughter in graduate school. Peer-to-peer payments are easy: you can transfer DVUs to any computer, anyplace in the world, with a few keystrokes.

Your e-cash is secure and can be authenticated easily. It is also anonymous; governments have not been able to mandate a technology that leaves a clear audit trail. Public-key encryption technology and digital signatures allow blind transactions; the receiving computer knows that the DVUs are authentic without knowing the identity of the payer. Your e-cash can be exchanged any number of times without leaving a trace of where it has been. It is virtually impossible to alter the value of your e-cash at either end of the transaction (by adding a few more zeros to it, for example).

DVUs are almost infinitely divisible. Given the virtually negligible transaction cost, it is efficient for you to pay a dollar or two to see a financial report over the Internet or for your teenager to rent a popular song for the few minutes during which it is in vogue. Microtransactions have become the norm.

E-cash is issued — actually created — by a large number of institutions, bank and nonbank. Electronic currencies (e-currencies) have begun to exist on their own; many are no longer backed by hard currency and have developed value separately from currencies issued by central banks. DVUs circulate for long periods of time without being redeemed or deposited. Consumer confidence in the issuer is crucial; as with electronic commerce (e-commerce) in general, brand names have become critical.

The early 21st century is described as a world of competing e-currencies, a throwback to the 19th century world of private currencies. The better known brands of e-cash are highly liquid and universally accepted.

Governance in the Digital World

Governance in the Digital World

In a world where true e-cash is an everyday reality, the basic role of government in a liberal market economy and the relevance of borders and geography will be drastically redefined. While this appears to reflect a traditional break between domestic and international economic issues, in fact the advent of e-cash raises serious questions about the very idea of “domestic” and “international” as meaningful and distinct concepts. The new digital world presents a number of governance issues:

-Can central banks control the rate of growth and the size of monetary supply? Private e-currencies will make it difficult for central bankers to control — or even measure or define — monetary aggregates.

-Will there still be official foreign exchange transactions? If you have $200 worth of DVUs on your computer and buy a program from a German vendor, you will probably have to agree on a mark-to-dollar price. However, transferring the DVUs to Germany is not an “official” foreign exchange transaction; the DVUs are simply revalued as marks. Without severe restrictions on individual privacy — which are not out of the question — governments will be hard-pressed to track, account for, and control the flow of money across borders.

-Who will regulate or control financial institutions? The U.S. Treasury is not sure whether existing reserve or reporting requirements would apply to all who issue (and create) e-cash. What about consumer protection in the event of the insolvency of an issuer of e-cash, a system breakdown, or the loss of a smart card?

-Will national income data still be meaningful? It will be almost impossible to track transactions when e-cash becomes a widely used means of payment, online deals across borders become much easier, and many of the intermediaries that now serve as checkpoints for recording transactions are eliminated by direct, peer-to-peer payments.

-How will taxes be collected? Tax evasion will be a serious problem in an economy where e-cash transactions are the norm and it is easy to transfer large sums of money across borders anonymously. More fundamentally, the question of jurisdiction — who gets to tax what — will become increasingly problematic. Say you are in Philadelphia and you decide to download music from a computer located outside Dublin that is run by a firm in Frankfurt. You pay with e-cash deposited in a Cayman Islands account. In which jurisdiction does the transaction take place?

-Will e-cash and e-commerce widen the gap between the haves and the have-nots? Will e-cash and e-commerce further marginalize poorer population groups and even entire poor countries?

-Will fraud and criminal activity increase in an e-cash economy? At the extreme — and the issue of privacy versus the needs of law enforcement is unresolved — transfers of large sums of cash across borders would be untraceable. Digital counterfeiters could work from anywhere in the world and spend currency in any and all places. New financial crimes and forms of fraud could arise that would be hard to detect, and it would be extremely difficult to locate the perpetrators. The task of financing illegal and criminal activity would be easier by orders of magnitude.

Geographic Space vs. Cyberspace

A recent U.S. Treasury paper raises a fundamental question: Will electronic commerce “dissolve the link between an income-producing activity and a specific location?” The source of an income stream, which plays a major role in determining tax liability, for example, is defined geographically in terms of where the economic activity that produces the income is located. Therein lies the rub: “Electronic commerce doesn’t seem to occur in any physical location but instead takes place in the nebulous world of ‘cyberspace.’”

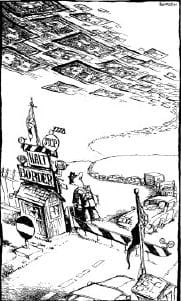

Territorial sovereignty, borders and a clear distinction between domestic and international spheres are modern concepts associated with the rise of the nation-state. Territorial sovereignty implies a world divided into clearly demarcated and mutually exclusive geographic jurisdictions. It implies a world where economic and political control arise from control over territory. The obvious disconnect between systems of economic and political governance rooted in geography and e-cash and markets that exist in cyberspace will only worsen over time.

The international financial system — which consists of hundreds of thousands of computer screens around the globe — is the first international electronic marketplace. It will not be the last. E-cash is one manifestation of a global economy that is constructed in cyberspace rather than geographic space. The fundamental problems that e-cash poses for governance results from this disconnect between electronic markets and political geography.

The term “disintermediation” was first used to describe the replacement of banks as financial intermediaries by direct lending in money markets when interest rates rose. It is often used in the world of e-commerce to describe the elimination of intermediaries by direct seller-to-buyer transactions over the Internet. Many observers argue that e-cash is likely to disintermediate banks. Of more fundamental importance is the possibility that e-cash and e-commerce will disintermediate the territorial state.

To be clear, I argue that we face not the end of the state, but rather the diminished efficacy of political and economic governance that is rooted in geographic sovereignty and in mutually exclusive territorial jurisdiction. Questions such as, “Where did the transaction take place?” “Where did the income stream arise?” “Where is the financial institution located?” and “Whose law applies?” will lose meaning.

E-cash and e-commerce are symptoms, albeit important ones, of an increasing asymmetry between economics and politics, between an electronically integrated world economy and territorial nation-states, and between cyberspace and geographic space. How this asymmetry will be resolved and how economic and political relations will be reconstructed are two of the critical questions of our time.

What is to be Done?

The question asked here is not “What is feasible?” but “What are the limits of the possible?” Whether the picture presented here is correct in all — or even some — of its details is unimportant. A digital world economy is emerging. Imagining possible scenarios is necessary if we are to come to grips with the consequences of this revolution.

A digital world economy will demand increasing international cooperation, harmonizing national regulations and legislation, and strengthening the authority of international institutions. The harmonization of national regulation will help to prevent institutions, such as those issuing e-cash, from slipping between national jurisdictions or shopping for the nation with the least onerous regulations. However, it will not address the basic problem of the disconnect between geographic jurisdiction and an electronically integrated global economy.

If it is impossible to locate transactions geographically — if the flows of e-cash are outside of the jurisdictional reach of every country — then the harmonization of national regulations will accomplish little. The basic problem is not one of overlapping or conflicting jurisdictions; it stems from the lack of meaning of the very concept of “jurisdiction” in a digitalized global economy. The erosion of the viability of territorial jurisdiction calls for strengthened international institutions. It calls for giving international institutions real authority to measure, to control, and, perhaps, to tax.

That does not mean a world government; it does mean a markedly increased level of international cooperation. It means we must ask whether territorial sovereignty will continue to be viable as the primary basis for economic and political governance as we enter the 21st century.

Stephen Kobrin, the William Wurster Professor of Multinational Management, is director of the Joseph H. Lauder Institute of Management and International Studies. This article was adapted with permission from Foreign Policy magazine, 107 Summer 1997. © 1997 The Carnegie Endowment for International Peace.